Read the original press release here.

What Does the Wealth Access Digital Banking Integration Look Like to Consumers?

We built the Wealth Access Digital Banking integration so regional banks could provide a unified portal that pulled in every aspect of your clients’ financial lives. Customers don’t have to worry about juggling multiple logins, and you don’t have to worry about renting out your customer experience to third-party data aggregators for everything from a customer’s mortgage to wealth relationship to basic budgeting.

In short, the intent is to provide a comprehensive client relationship directly on your website, regardless of which online portal your customer enters through.

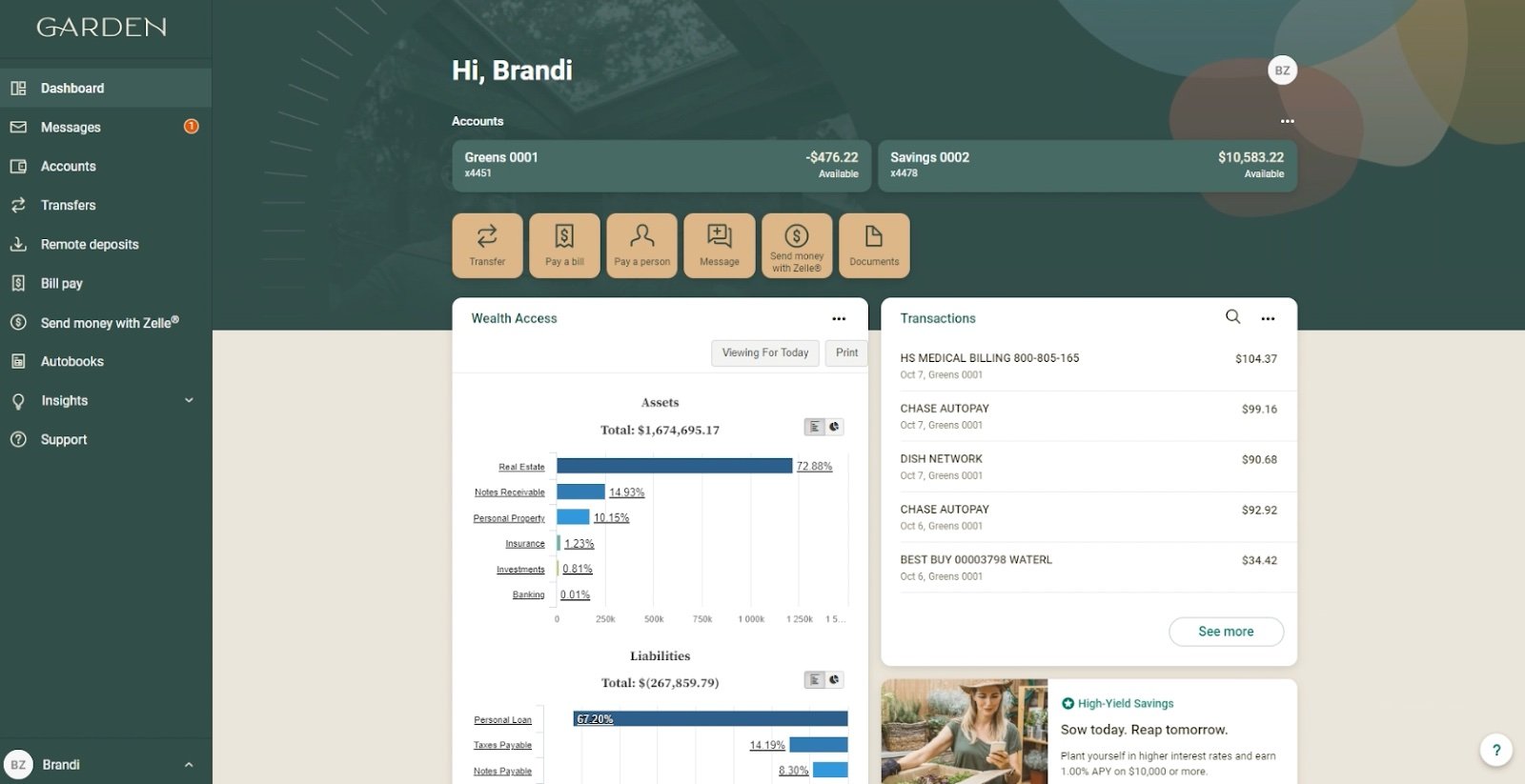

Sounds great, but what does that look like? Let’s jump in using a fake client account at a fictitious bank called Garden.

How Wealth Access Can Enhance Your Digital Banking Experience

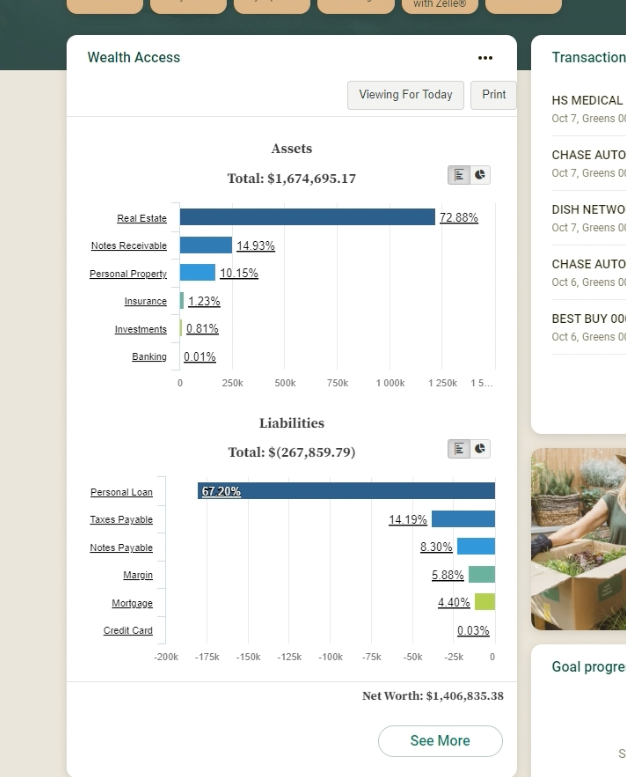

First up, we’ll look at the Personal Financial Management widget, which we call the PFM.

The PFM is a full personal financial management tool that can be utilized across the enterprise, meaning clients who have both consumer and wealth relationships can aggregate their held-away accounts once and have that info in a full financial balance sheet, visible regardless of which portal they access it through.

For banks without a wealth practice, the PFM provides consumers with visibility into their total financial health, allowing consumer clients to track and manage finances and spending.

If you’re at a regional bank, you know the headaches that come with getting your clients to see their full financial picture all in one place. Want to see your mortgage info? Go log into the mortgage portal. Want to see your wealth management numbers? Go log into the wealth management portal.

If that’s how everyone did it, then that wouldn’t really be a problem. But customers don’t have to do that at a bigger bank like JP Morgan or Bank of America.

And that can be a big problem for regional banks. According to a PYMNTS report published earlier this year, roughly one-third of banking customers said digital banking capabilities were a reason they would consider switching banks.

That’s why we created the Digital Banking integration – so regional banks can offer a unified portal experience on par with what the “big guys” are out there doing already. Your bank is just as good as, if not better than, the national chains, and there’s no reason your customers should feel like they have to make concessions by banking with you.

In the PFM, your clients can see their entire financial picture right away – held-away assets and everything – with all of the data automatically summarized and categorized for them.

And every line item is fully interactive, as you can see below.

Your customers can see how their spending matches up with their income, and drill down into individual transactions.

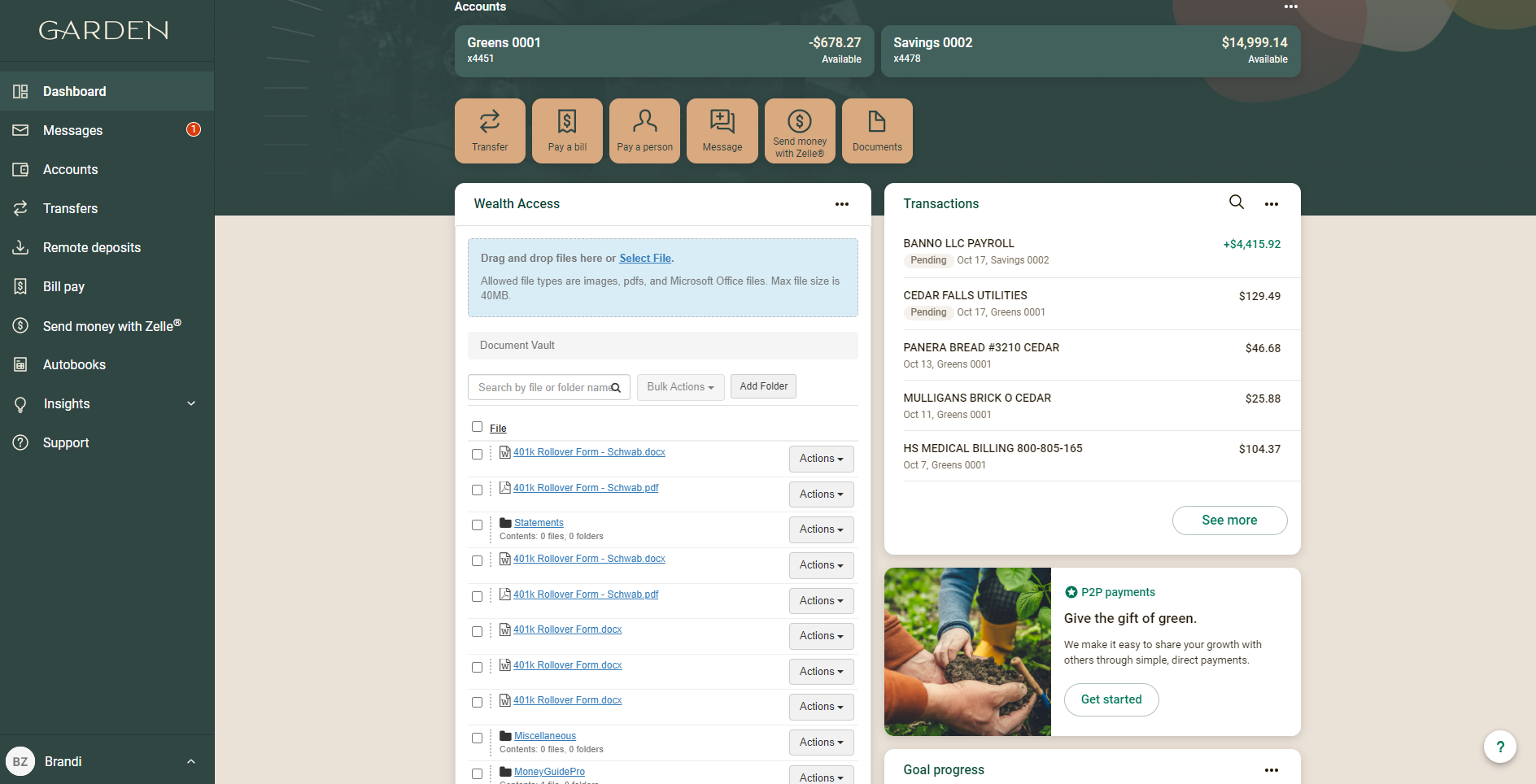

Document Vault

The PFM widget also includes our recently updated Document Vault, which allows for better organization of document types (including account statements, tax documents, and more) into standardized tabs, as well as improved filtering capabilities by file name, account and date.

The Vault makes document management easier with the following tabs:

Overview Tab – Displays all documents uploaded to the Vault either systematically or manually over the last 30 days.

Statements Tab – Displays all feed-driven account statements for the last 90 days by default. Users may select additional date ranges for viewing.

Tax Documents Tab – Displays all feed-driven tax documents for the user’s accounts for the current calendar year, or selection of additional date ranges.

Personal Storage Tab – This is the only option that allows the user to upload or delete documents. The Personal Storage tab allows clients to manually upload and store any additional documents (up to 40MB) they want to have readily accessible.

Just like everything else in our Digital Banking integration, the Document Vault is accessible from any portal.

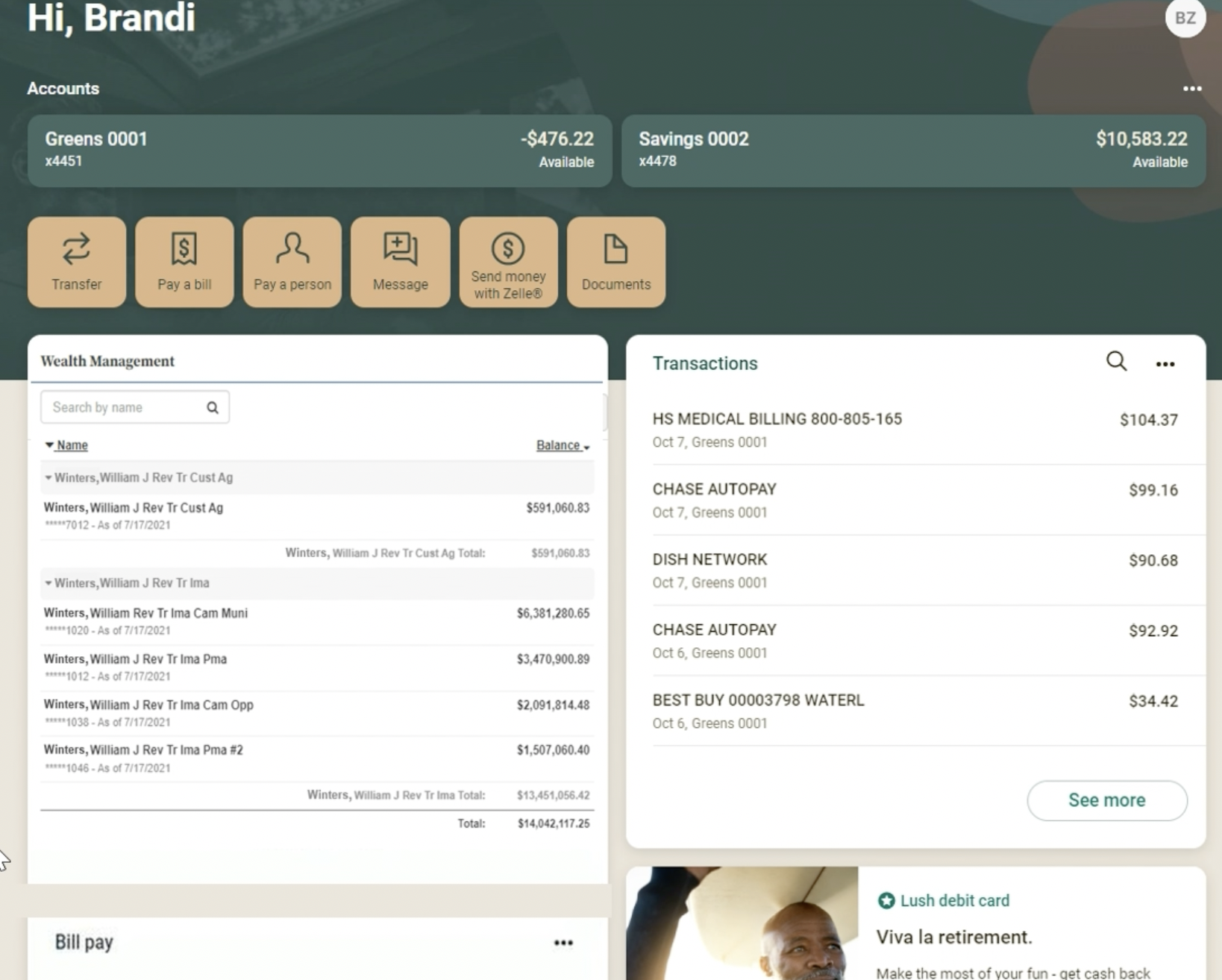

View Wealth Accounts (and More)

The Wealth Access widgets can pull in any number of accounts your clients have across your entire institution: wealth, business, personal, trusts and more.

The whole idea behind our Digital Banking initiative is to open the door for smaller banks to be able to provide comprehensive experience within your consumer digital portal.

Want to Bring the Digital Banking Integration to Your Bank’s Website?

Click here to schedule a quick conversation with our sales team today.