When you think of digital customer service, what’s the first thing that comes to your mind?

How Banks are Powering the Small Business Economy

Small business is big business in the United States.

Nearly half of all Americans are employed by a small business, and there are 30 million small to midsize business owners in the country.

So if your bank or wealth management firm is making it a priority to serve business owners, you’re tapping into a highly desirable and competitive client segment.

Whether or not you can capitalize on the opportunity and turn business banking customers into long-term, multi-faceted clients of your institution is another story.

And that’s where your firm’s technology—and your customer data platform—can help make or break your ability to grow by serving business owners.

Challenges that Financial Institutions Face When Serving Business Banking Customers

Banks face two primary challenges when it comes time to creating a differentiated experience for their business banking customers.

Challenge 1: Inaccessible Data

The first challenge that banks face is a common one. They use so many technology applications, systems, and books of records that their data is stored in a hundred various places.

And even though they can access data by logging into any one of those places, they don’t have a single location to access all that data at the same time.

As a result, data feels inaccessible and not unified. And that feeling of incomplete awareness leads to challenge number two.

Challenge 2: Inability to Provide Comprehensive Financial Views

The second challenge is about how banks interact with their business banking customers. On average, small business owners tend to present more high income, sizable portfolio opportunities—and a bank with multiple business lines that can work together can not only serve SMB owners on the business banking side, but also within the wealth and retail divisions.

A bank with unified data across systems would be able to gather insights where other institutions couldn’t—like knowing if a banking customer is already being served by another division of the bank.

And if so, the bank has the opportunity to showcase a completely unified, 360 degree financial statement of that customer’s life—with business, wealth, and retail combined.

When data isn’t unified, though, that type of experience becomes almost impossible to deliver.

How Wealth Access for Business Transforms Customer Service

Thankfully, banks have solutions for these challenges. One of the answers? We call it Wealth Access for Business.

First, we help you solve the first challenge with a light-touch platform that sits on top of your existing books and records and other systems. There isn’t a painful conversation process that asks you to leave all your other technology behind.

Instead, our Customer Data Insights platform ingests data from across every nook and cranny of your organization, and we use a unique client identifier to normalize and enrich that data.

When that’s done, you have all your data in one place—and you are now ready to deliver hyper-personalized digital experiences to all your business bankers and the business owners they serve.

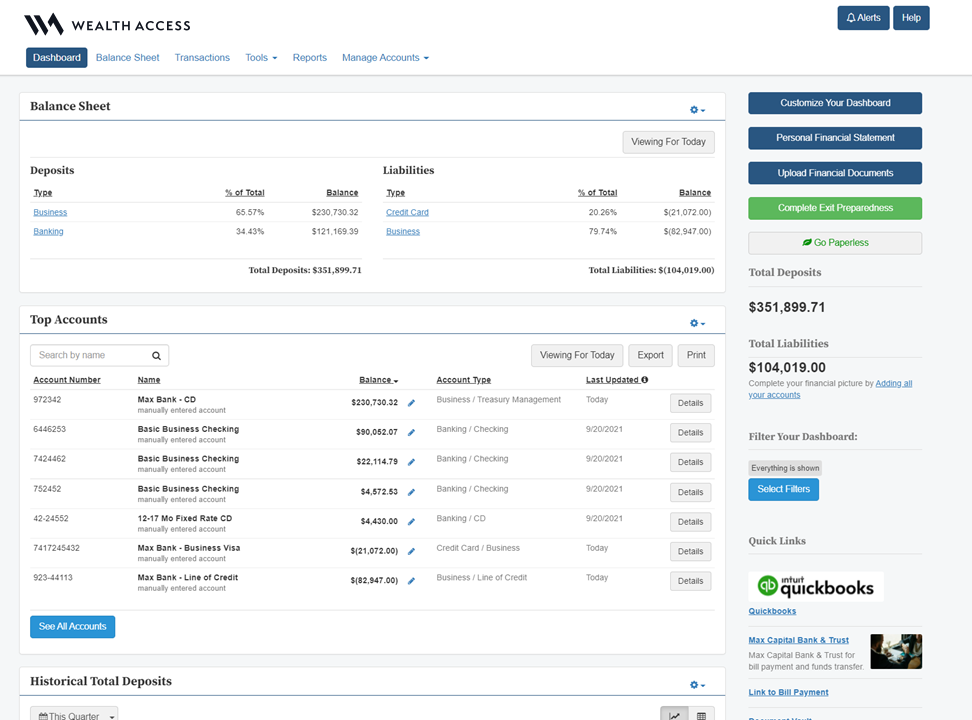

Business Owner Hub

The Business Owner Hub transforms the way business owners interact with their bank digitally. It consolidates and displays all of the customer’s accounts in a single view—from personal checking to their business accounts.

Beyond showing a read-only view of accounts, though, the Hub also enables held-away account aggregation and bi-directional document sharing between business bankers and business owners to enhance your firm’s client communication capabilities.

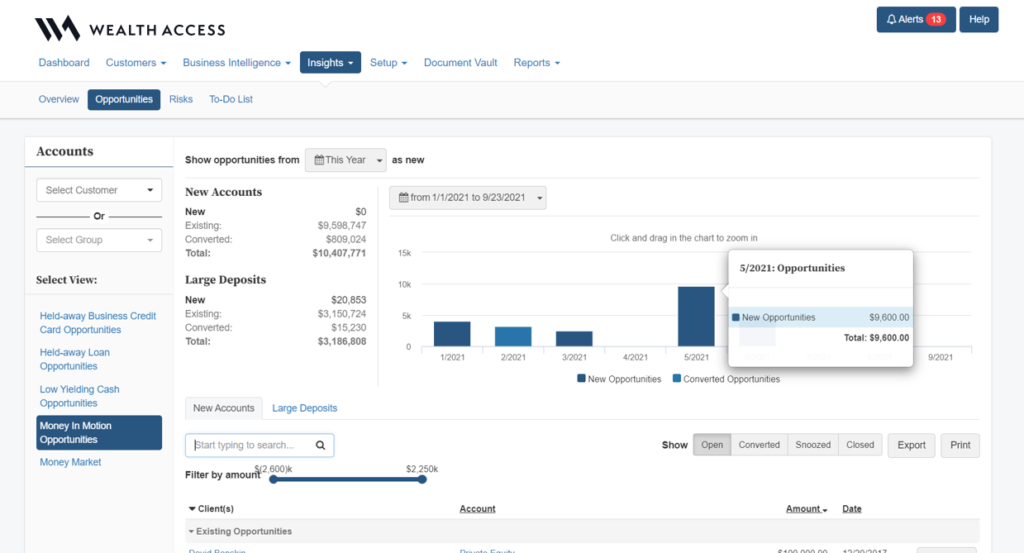

Business Insights for the Business Banker

We couldn’t provide a top tier customer digital experience and not give your firm’s bankers the same type of experience.

Through our Business Banker Portal, your staff gets clear views into the entire deposit and liability exposure that their SMBs have with the bank, plus a view into any additional financial accounts the business owner has added through the Business Owner Hub. This experience is coupled with Business Insights for Bankers which proactively highlights money in motion, opportunities by type, and high-level views across accounts so they can see where they need to proactively make decisions to improve service and profitability.

Ready to See it for Yourself?

Click here to schedule a tour of Wealth Access now.