What do you get when you bring 30 of the country’s top regional and super-regional banks together...

Improve Customer Communication with Shared Account Access

From the middle class to the wealthiest families in the country, most families find it incredibly difficult to talk about money. In fact, a BNY Mellon study found that lack of communication could be the culprit behind the loss of up to 60 percent of family fortunes.

For banks, the loss of a family fortune can also mean the loss of those assets and even the loss of a customer completely.

While we can’t directly help you find ways to make customers talk to each other more, we can offer one solution for addressing the communication gap: Technology designed to make it easier to improve customer communication within families.

Today’s blog looks at the all-new Shared Account Access feature, designed to help families get a complete and unified view of their wealth, without the hassle of multiple logins.

Why Share Account Access Can Improve Customer Communication

In situations where it’s difficult for family members to discuss finances, Shared Account Access can still provide a way to provide transparency and visibility into a complete family household’s wealth picture.

In cases where parents want to include their adult children’s accounts in their complete balance sheet, Shared Account Access makes that ask as simple as a request within the software platform.

Or, spouses with separate accounts may want to keep their money and accounts separate but still both be able to see a complete view of their combined wealth.

Again, Shared Account Access makes these types of comprehensive financial views easy to accomplish.

Here’s how to get started with enabling this feature for your firm and the customers you serve.

How to Enable Shared Account Access

Shared Account Access enhances your customer experience by making it easy for anyone to share accounts with one another, so long as both parties have accounts at your financial institution.

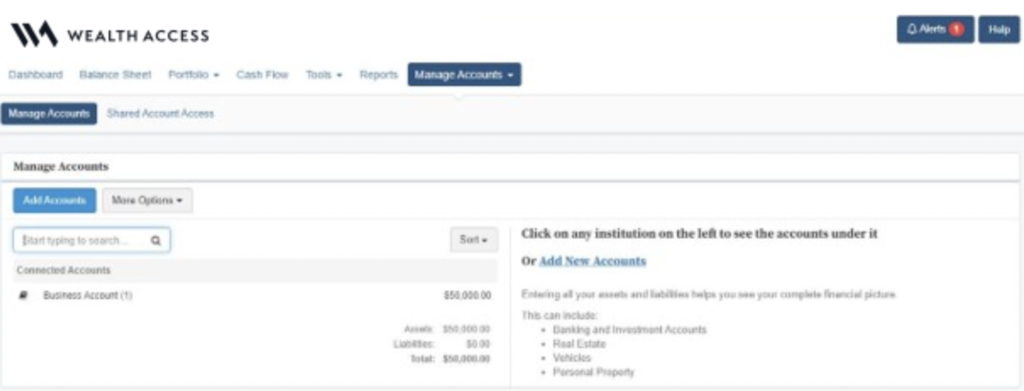

If an individual has constructed his or her entire living balance sheet in Wealth Access, they can now easily share those account views with a spouse, children, or even other individuals within your financial institution so the accounts can be displayed on the other individual’s balance sheet in addition to their own.

One important distinction upfront: We do ensure that both parties are fully aware and approve the request to share accounts before anyone receives access, to prevent the accidental sharing to someone unrelated to the initiating party.

Shared Account Access can be enabled at the firm level through your Wealth Access administrator.

Once enabled, customers can share account views in seven fast and easy steps.

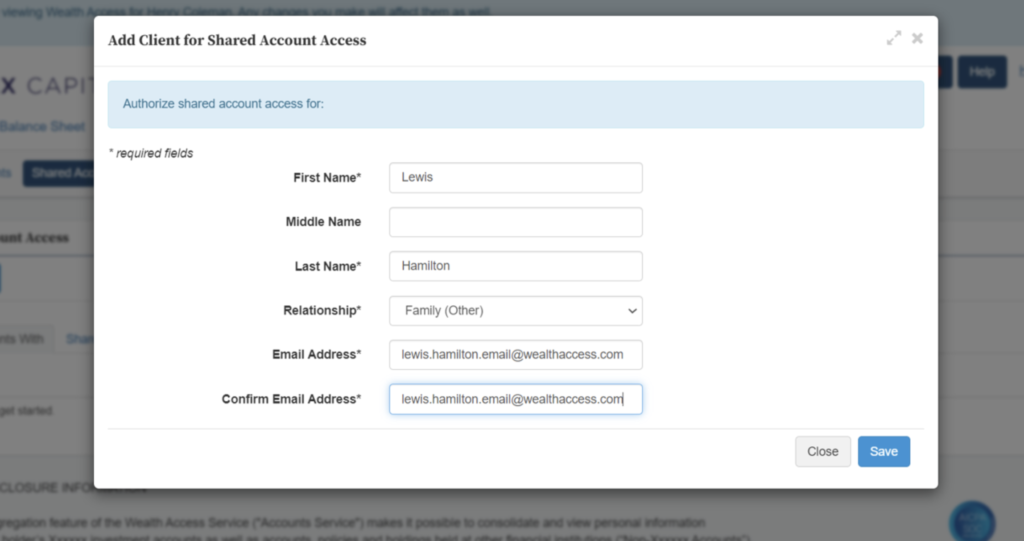

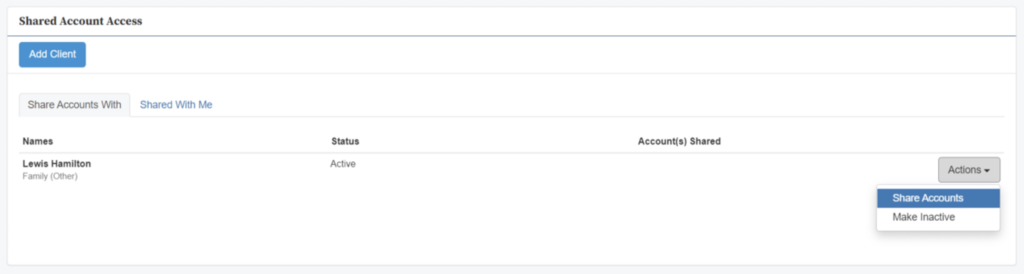

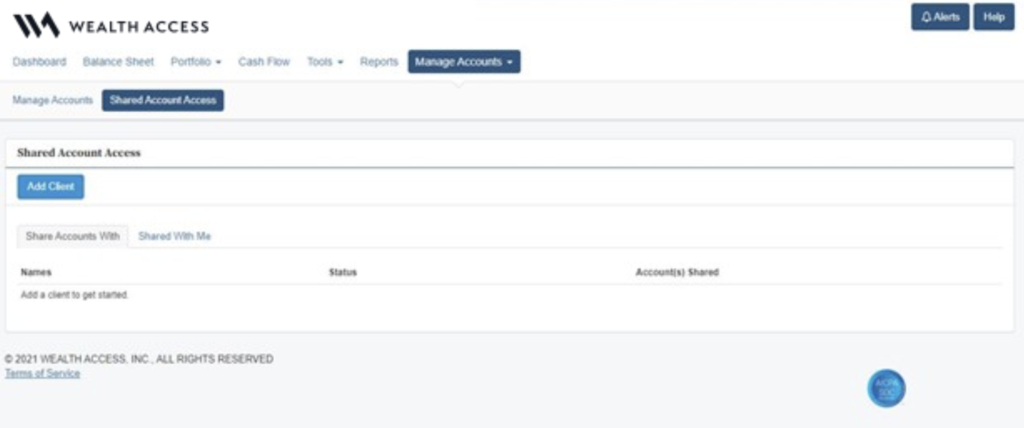

STEP 1: Client clicks ‘Add Client’ to identify individuals to share accounts with.

STEP 2: Client fills out other individual’s information.

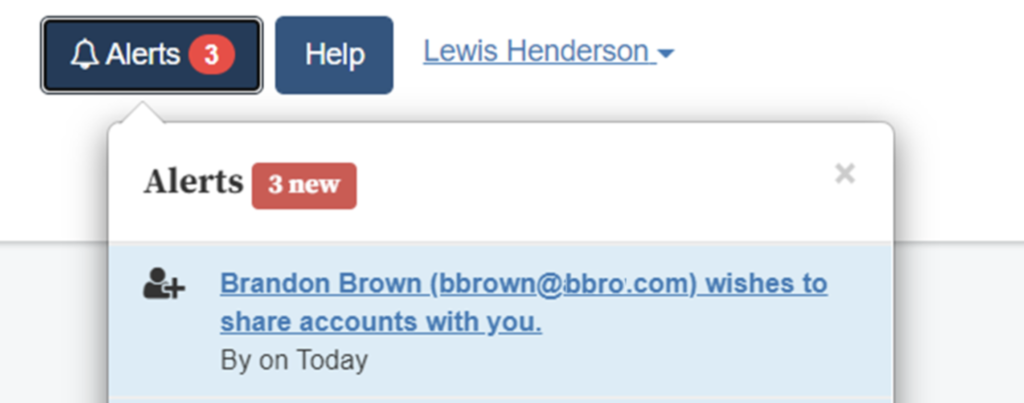

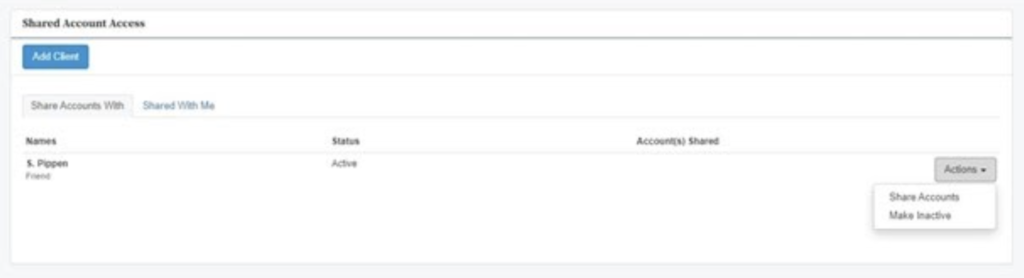

STEP 3: The other individual receives an in-app alert that a client wishes to share accounts with him/her.

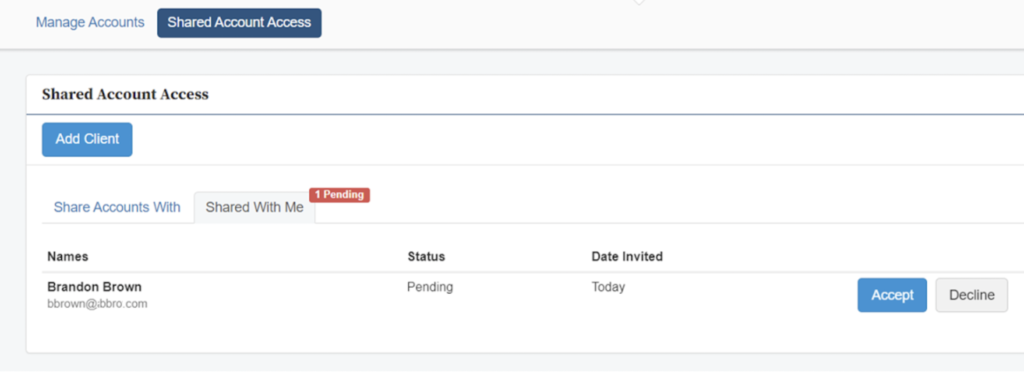

STEP 4: The individual accepts the request for the client to share accounts with him/her.

STEP 5: The initial client can now share accounts with the selected individual.

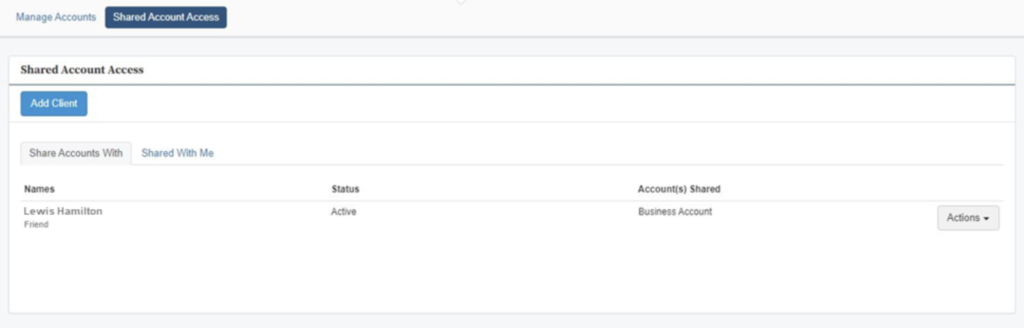

STEP 6: The client proceeds through a workflow to select accounts, acknowledge a disclosure, and review & submit.

STEP 7: Accounts have been successfully shared and are now viewable by the other individual.

Getting Started with Shared Account Access

If you’re already a Wealth Access user, simply contact our Support Team to request that the Shared Account Access functionality be turned on for your firm.

If you don’t use Wealth Access, now is the best place to schedule your first consultation call. Tell us about your needs and we’ll help you see how Wealth Access can help you generate deep insights with your data.