Small business owners are some of the best clients a bank or financial firm could ever want. They...

Wealth Access and FIS Global: A Partnership for Better Banking Tech

Regional banks face stiff competition. National financial institutions have higher marketing budgets, top-tier tech solutions supported by a full-scale staff of IT professionals, and a wider range of potential customers worldwide.

To get a competitive edge and secure their local market, decision makers at regional banks have to partner with leading platforms that give them the types of capabilities and digital client experiences that the bigger brands have built for themselves.

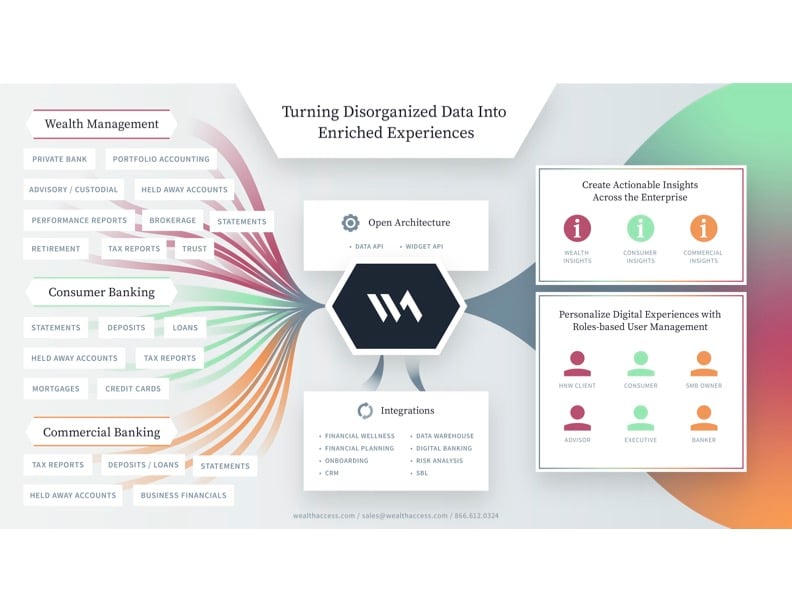

At Wealth Access, we keep those needs at the core of every product decision we make, including the software integrations we invest in on behalf of our customers.

In fact, bringing open API-first innovation to the table is one of the key ways for regional banks to get access to richer digital experiences that connect across their technology ecosystem.

While big-brand tech usually caters exclusively to large financial institutions, Wealth Access is putting regional banks first. Our open architecture platform allows us to integrate with the most sought-after technology companies for regional banks and other financial institutions – including Jack Henry, Q2, NCR and others. To help you learn more about each of them, we’re publishing a new series that focuses on our integration partners, starting with today’s article about our partnership with FIS.

Read on to explore how FIS delivers leading technology to banks and how our integration further deepens those capabilities for your organization.

Who is FIS Global?

We’ll wager that if you’re at a banking organization then you know FIS well, but if you aren’t deeply familiar with the company, we’ll start with the basics.

FIS Global is a financial technology platform created primarily for banks, capital markets firms and merchants. And they are a crucial part of the global economy; FIS processes bookkeeping and transactions for over half of the world’s total wealth, handling $10 trillion each year.

Founded in 1968, the company now has more than five decades of experience providing a range of solutions for banks, including:

- Wealth and retirement management

- Optimized operations

- Cashflow and capital management

- Trading and investing enhancement

- Data insights

FIS Global was bought by Fidelity National Financial in 2003 and has since been named a Fortune 500 company. Currently, FIS Global is listed on the S&P 500 and headquartered in Jacksonville, Florida.

Because FIS is so widely used – working with 95% of the world’s leading banks – it’s crucial that Fintech innovators and banking technology providers build systems that can not only integrate with FIS Global, but also enhance the digital experience for the many financial institutions who rely on them.

The FIS Global Integration with Wealth Access

Here at Wealth Access, we’ve created every part of our platform with open API architecture, with the goal of integrated data unification for financial institutions. Our platform integrates existing books and records, unifying data from core banking products as well as across all four available FIS trust and custody accounting platforms:

- TrustDesk

- Global Plus

- AddVantage

- Charlotte

In addition to the four trust platforms from FIS, Wealth Access has also developed integrations with other FIS platforms like IBS (Integrated Banking Solution), Unity Wealth and Relius.

Our enhanced client portal delivers mobile-first functionality to our joint FIS clients, making banking on the go for the end customer easier than ever. We also support reporting and data intelligence for wealth management, trust, and banking clients.

How the FIS Global Integration Works

FIS Global and Wealth Access have worked together to develop an end-to-end, component-based, flexible solution that leverages proprietary platform technology and is surrounded by a broader set of services that enables unique competitive differentiators.

Together, we provide a complete technology solution that you can private label with your bank’s unique brand. Instead of investing time and money developing and maintaining a custom mobile app, which can often take upwards of a year to develop, you can leverage Wealth Access for a private-labeled, fully functional mobile app with deep integration to the remainder of your wealth platform.

And with our custom-designed Catalyst implementation program, you can be up and running with your new technology faster than you might think.

Beyond a mobile experience, banks can expect client data unification across business lines, analytics and business intelligence, investment performance and client reporting, and more from FIS and Wealth Access’ cohesive platforms.

Open APIs: Making Deeper Integration with FIS Global Possible

A Quick Refresher: An API (Application Programming Interface) is a set of protocols, routines, and tools for building software and applications.

Essentially, an API acts as a mediator between different software systems, enabling communication and data exchange between them. APIs help to simplify integration, provide real-time data access, and offer many other services such as account verification and payment processing.

Since open APIs are cloud-based, anyone you’ve granted access to with internet and a device can easily work within your system, creating greater functionality for both consumers and your employees. For example, Wealth Access’ open API provides a total balance sheet that can be efficiently evaluated by underwriters in the event that they need to apply for a line of credit for their business.

The banking sector has historically lagged in API technology adoption due to a strong emphasis on confidentiality, outdated technology, and data access challenges.

However, open banking initiatives are pushing for change by giving consumers control over their data and promoting API use and investment in the financial services industry. Leading financial institutions are recognizing the potential and need for API integration, and building their development roadmaps to follow suit.

It’s this same open API technology that allows Wealth Access to work seamlessly with FIS Global and other leading technology companies, bringing your regional bank the best-in-class resources you need to serve your customers on the same level (or better) than the biggest brands around.

Build a Better Digital Banking Experience with Wealth Access

Does your bank work with FIS Global? Are you looking to scale your client experience?

Wealth Access can help you maximize your investment in the FIS platform. Click here to schedule a consultation about your banking technology today.