Regional banks face stiff competition. National financial institutions have higher marketing...

How Wealth Access Creates a Better Commercial Banking Experience

Small business owners are some of the best clients a bank or financial firm could ever want. They are responsive, they need the services you provide, and the better you serve them, the more business they’ll give you. Not only that, but they can be a lucrative source of referrals as they often network and share ideas with other business owners.

With more than 33 million small businesses currently operating in the United States and an average of 4.4 million new ones opening each year, there is no shortage of entrepreneurs who need help storing and managing their finances.

On top of that, nearly half of small businesses are planning to or already have changed their business model in response to the pandemic, and they are looking for financial partners who can support them in this transition.

However, traditional banking software often falls short in providing personalized experiences for small business owners. That’s where partnerships come in, and why we believe that the future of banking lies in data.

Welcome to our latest blog series on the value of partnerships in the banking tech industry. At Wealth Access, we understand the importance of creating personalized experiences for customers – and that’s why we work with the leading platforms in commercial banking.

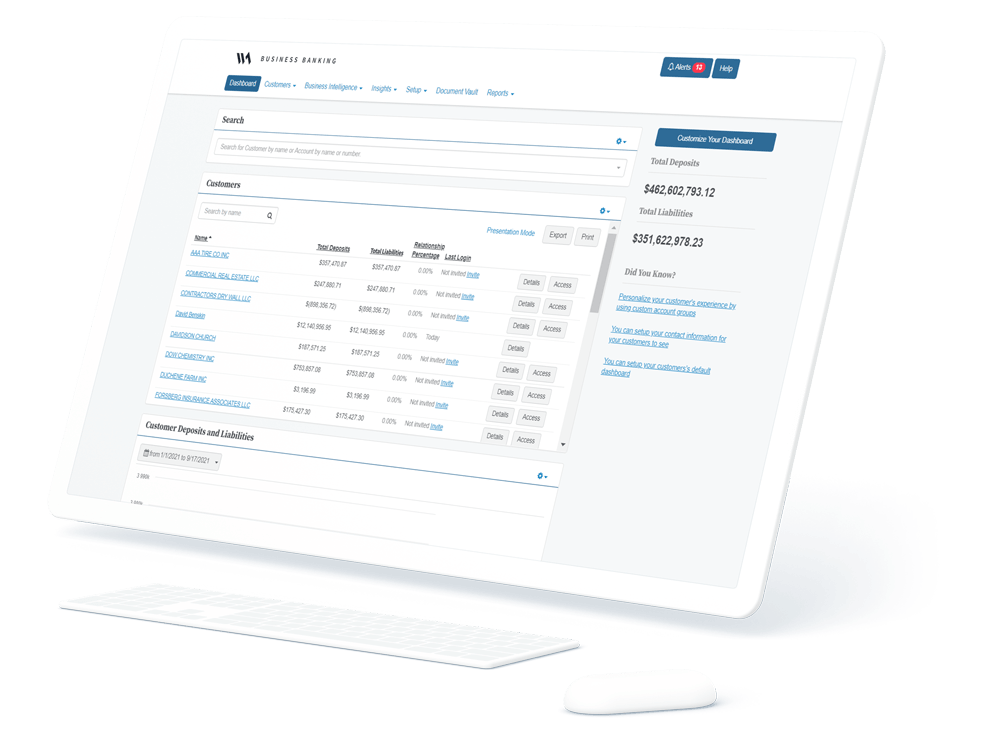

At Wealth Access, we partner with a vast array of finance and software companies to allow our users to build customer and employee dashboards that fit their exact needs. One of those integrations is with FIS Global’s commercial banking solutions.

How Wealth Access and FIS Build Commercial Banking Solutions

One of the reasons our integration with FIS works so well is our shared commitment to API-first solutions. Using the FIS commercial banking open platform, we have built out new applications that support commercial banking units and add real value to regional banks.

The collaboration results in seamless data transfer, scalable integration, and roles-based experiences with real-time information.

Roles-based experiences

Your bank can present complete, enriched financial views for both your team and prospects with roles-based experiences. By acting as the customer data unification platform for enterprises, Wealth Access ensures that all account information collected can be presented throughout an omni-channel, digital customer experience.

Wealth Access also gives your clients direct access to their cash flow, spending behaviors, financial planning status, as well as two-way sharing of important docs through the Document Vault.

These solutions have been custom-built for business owners, and are easily deployable through a roles-based experience to create the optimal setup for your clients.

Real-time data

Business owners rely on up-to-date information to make sound business decisions. The open API connection in our program provides immediate access to data – so your customers can get vital real-time information about the day-to-day health of their business.

Related: Click here to find out how Fulton Bank brings data to life for customers with Wealth Access

With Wealth Access and FIS, data is uploaded as fast as an API connection can handle, boosting your bank’s efficiency and reducing opportunities for error.

The FIS Commercial Banking Integration with Wealth Access

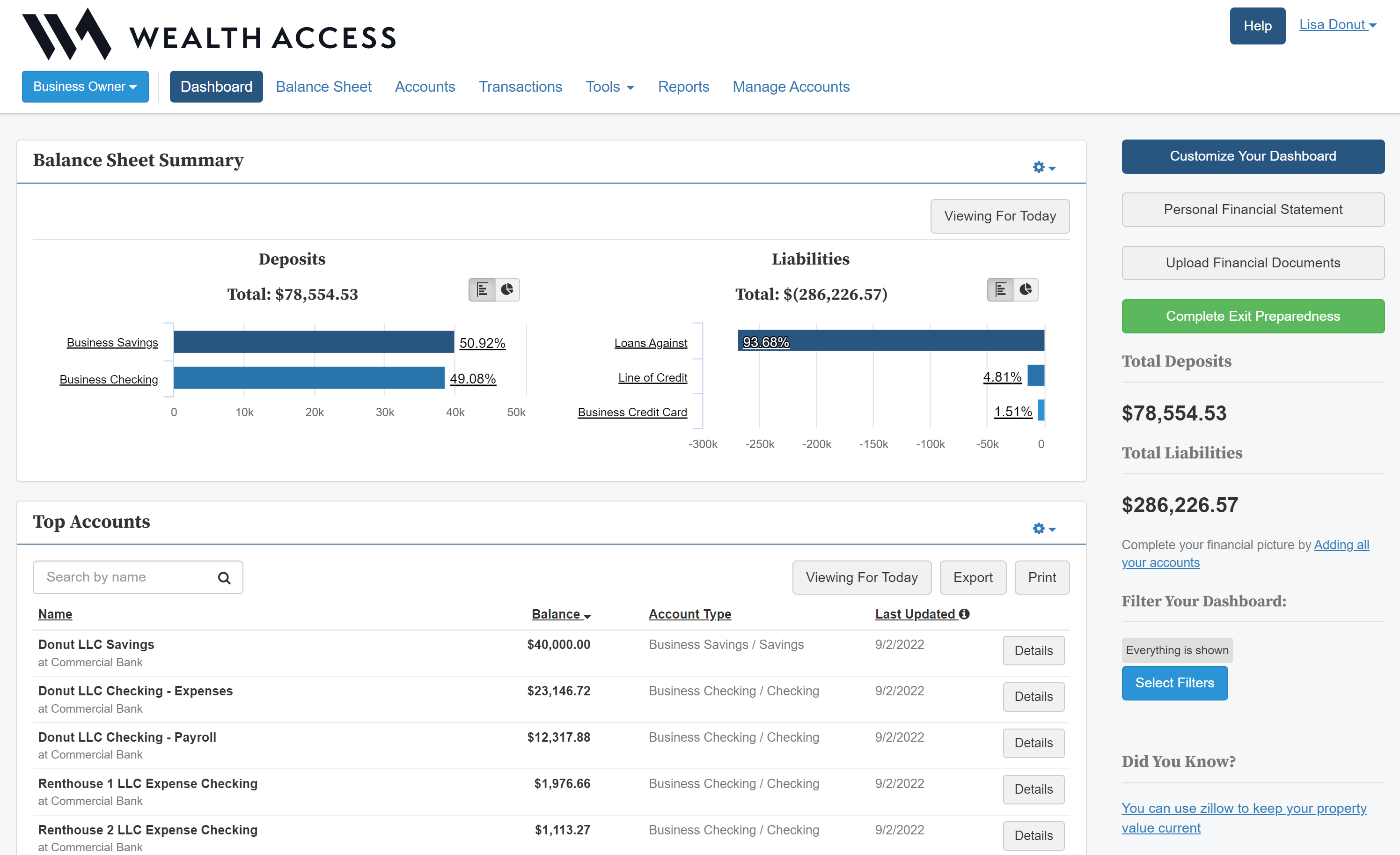

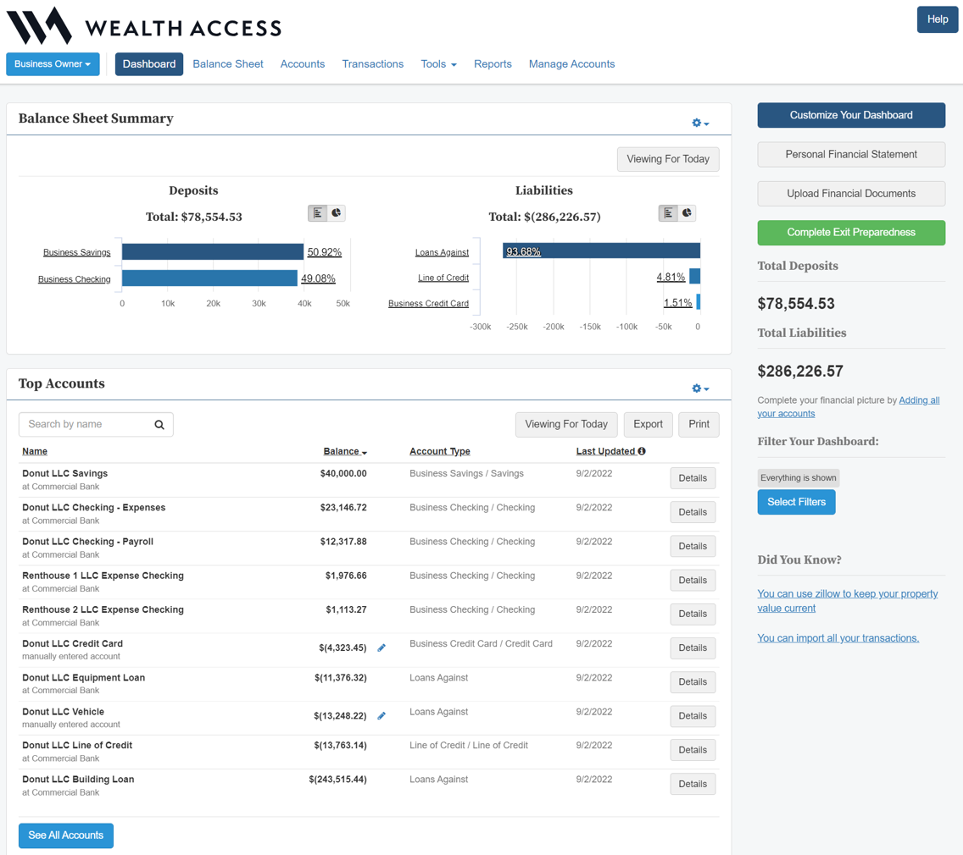

Wealth Access’s platform offers a user-friendly and intuitive interface, making it easy for small business owners to manage their finances and access the capital they need to grow their businesses.

The platform also provides businesses with access to a wide range of financial products and services, including business loans, lines of credit, and cash management solutions. For example, the integration of Wealth Access’s wealth management platform and FIS’s Commercial Lending Suite, which provides built-in workflow and analytics.

The integration of Wealth Access’s wealth management platform and FIS Global’s Commercial Banking along with the FIS Modern Banking Platform creates a unique solution that combines financial insights, lending capabilities, and wealth management solutions all in one seamless platform.

As a result, small business owners have access to a comprehensive view of their financial picture, including real-time access to their cash flow, expenses, and investments. This information is then combined with lending capabilities, making business banking easier for small companies on the grow.

The benefits of a holistic financial platform can’t be overstated. In addition to a smoother operating experience, banks can expect:

Improved decision-making

With a comprehensive view of a customer’s financial situation, commercial banks can make more informed decisions about lending and other financial services. This can help reduce the risk of loan defaults and improve the overall profitability of the bank.

Enhanced customer experiences

By having a complete financial picture of their customers, commercial banks can offer more personalized financial products and services, thus improving customer satisfaction and increasing loyalty.

Better risk management

A comprehensive financial view can help commercial banks identify and manage potential risks. For example, if a customer has a large outstanding loan balance, the bank can take steps to mitigate the risk before it becomes a problem.

Rather than manually combining data across several platforms, banks can gain a clear picture and make informed decisions in just a few clicks.

Do More with Wealth Access

Whether your bank works with FIS Global or other core BankTech platforms, Wealth Access can be the data platform you need to unify your organization’s processes and scale your client experience.

Wealth Access can help you maximize your investment in the platforms powering your firm. Click here to schedule a consultation about your banking technology today.

Wealth Access and FIS are separate and unaffiliated companies. All product and company names are the registered trademarks of their original owners. The use of any trade name or trademark is for identification and reference purposes only and does not imply any association with the trademark holder of their product brand.