Wealth Access continues to make investments in the development and extension of your mobile/digital...

February 2021 Wealth Access Release Notes

Wealth Access continues to make investments in the development and extension of your mobile/digital client experience and the advisor and firm tools that help drive insights and efficiencies in your organization.

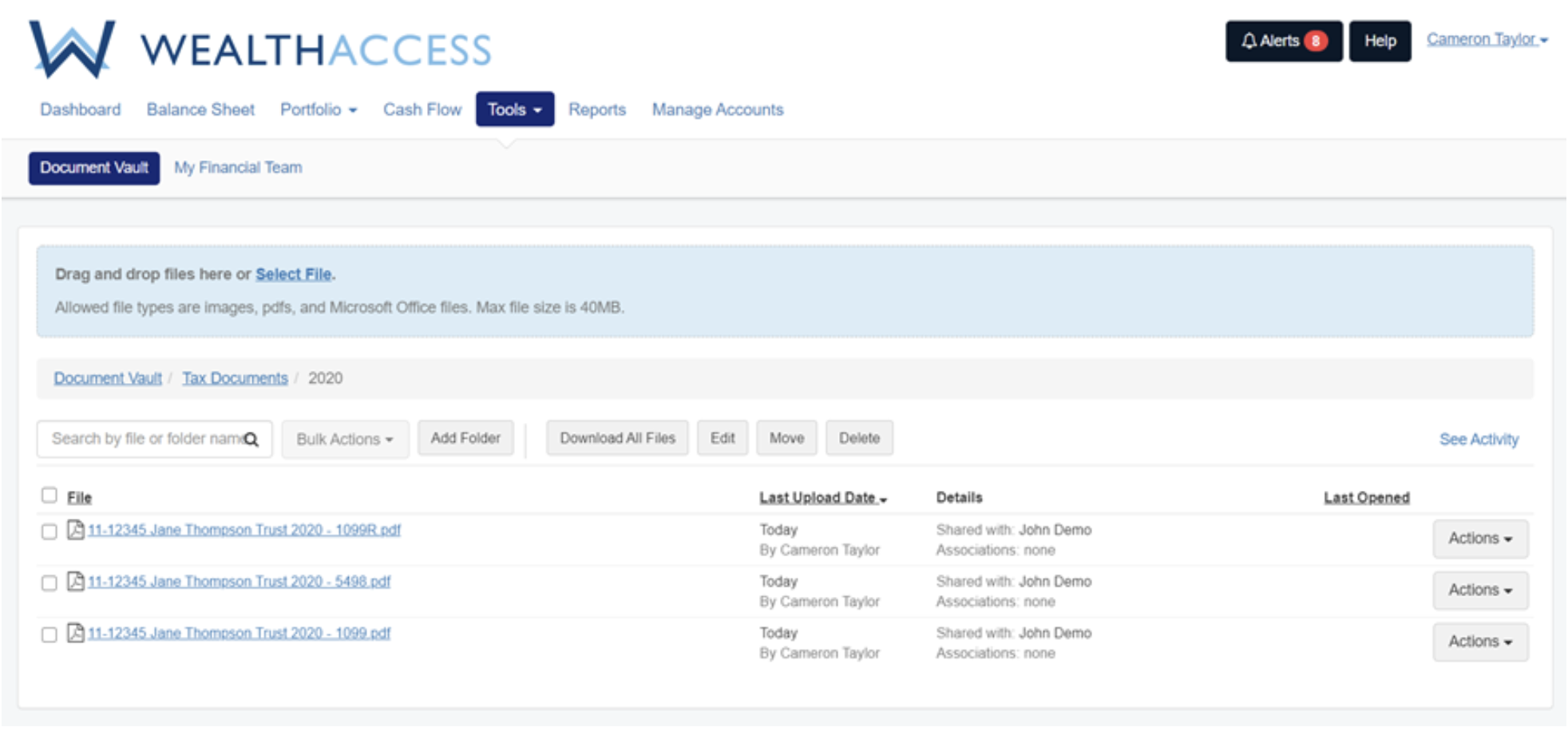

To support your ongoing commitment to your clients to deliver a compelling, digital user experience that promotes financial well-being, we have enhanced our tax reporting integration layer and are excited to bring you more options to deliver tax documents digitally to your clients through document vault integration.

Tax Reporting Integration

We recognize the specific role we play in delivering an exceptional digital experience to your clients by facilitating complete and transparent views into their financial well-being, including the ability to access tax documents digitally.

We have established direct integration with two leading tax information providers to facilitate the automatic delivery of tax documents to clients’ document vaults, with automated notifications to clients when new tax documents are available.

To learn more about our tax reporting integrations, please reach out to the Wealth Access Client Success team.

We are excited to announce integration with FIS Wall Street Concepts, a leading provider of tax information reporting outsourced solutions to the financial services industry to facilitate production of tax forms for domestic, retirement and nonresident alien accounts.

We are excited to provide integration with ONESOURCE, a leading provider for tax, accounting, and research solutions for corporations.

Wealth Insights

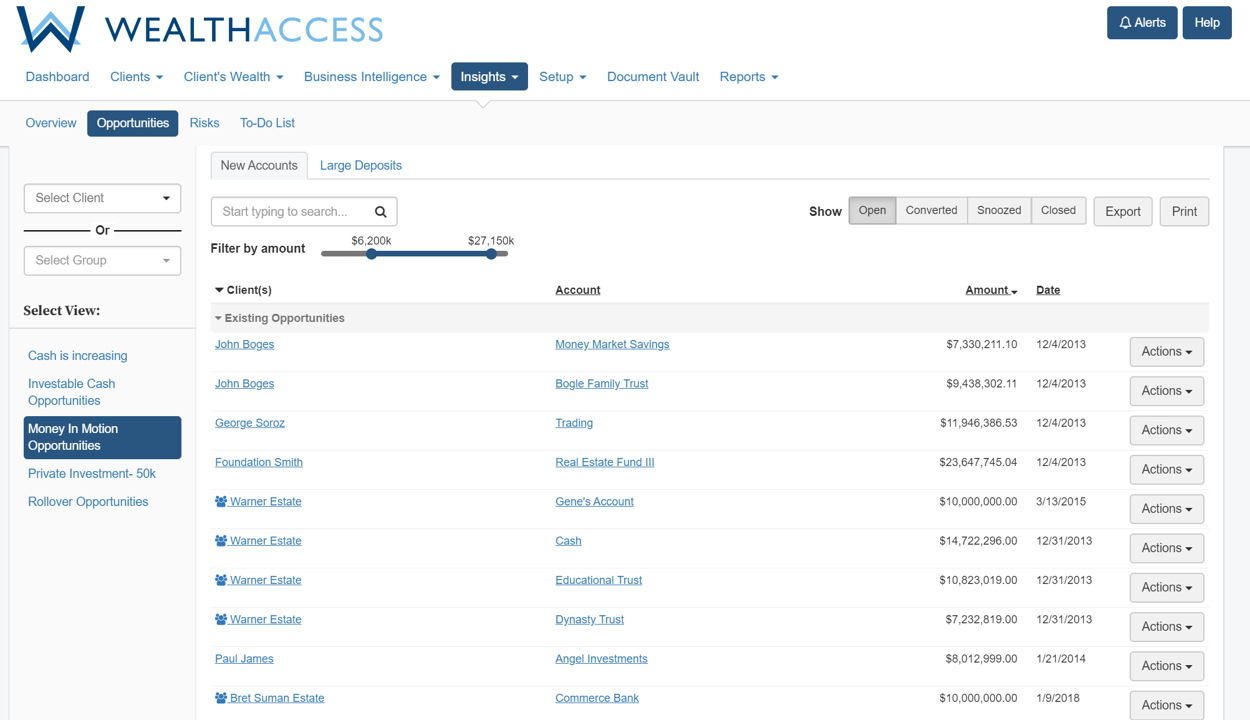

Wealth Insights proactively identifies opportunities, trends, and risks across your client base by applying business intelligence techniques across clients’ account data, login activity, and profile information. The insights are delivered through intuitive and easy-to-use dashboards so your firm executives, administrators and advisors can respond and take action to deliver a higher level of client satisfaction and to move additional assets from held-away to managed.

If your firm is interested in applying our business intelligence engine to proactively identify opportunities and risks across their set of clients, Wealth Insights is now generally available to client organizations that also subscribe to the Firm Insight module.

Advisor Opportunity Dashboard

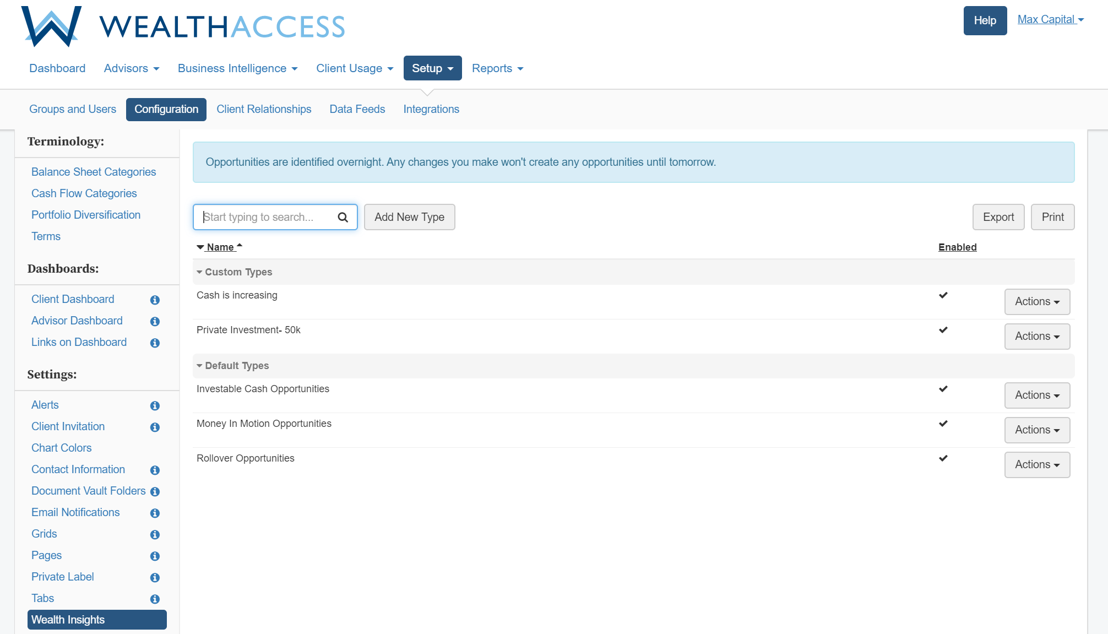

Configure Firm-level Opportunity Types

Data Infrastructure

Liability Accounts

Wealth Access is focused on helping the wealth community make intelligent decisions through full balance-sheet reporting across all of a client’s financial assets.

We understand the importance of representing liability accounts on the balance sheet and in account-level views. We are making an important enhancement to ensure holding-level views and asset class views stay true to representing the asset side of the balance sheet.

This enhancement will enable the following:

- Balance Sheet and Account Views: will represent liability-based AND asset-based accounts

- Holdings View: will represent holdings associated to ONLY asset-based accounts

- Portfolio Diversification View: will represent the asset allocation associated to holdings of ONLY asset-based accounts

This enhancement will be enabled automatically for all firms.

Wealth Access Data Services

The Wealth Access platform runs on data and we are committed to continued investment in our data infrastructure to meet our clients’ growing needs.

Wealth Access Data Dashboard. We are enabling a firm admin-level dashboard to provide increased transparency on timing and statuses of direct data feeds and statement delivery. Through a new Monitoring tab, firm administrators will now have visibility into when data feeds are processed, the number of statements received during a time period, and be alerted if there are any delays. Coming in Q2 2021.

Salesforce.com Integration. We are excited to establish integration with Salesforce.com to enable the automatic delivery of Wealth Access data sets directly into your Salesforce.com instance. Look for the new Wealth Access app in the Salesforce.com AppExchange in Q2 2021.

Multi-faceted firms. We continue to ensure that we represent the entire financial picture that end clients have with your firm, by consolidating financial assets across trust, brokerage, wealth, retirement, banking, credit card, and insurance divisions at the household level.

Full balance sheet reporting. We are broadening the breath and depth of supported financial services institutions to ensure that your end clients have a single, financial dashboard, and also that your financial professionals have visibility into all of the clients’ financial assets.

Data aggregation. We are bringing more aggregation partners into our data aggregation as a service (DAAS) model to improve the accuracy and stability of held-away account data services.