Wealth Access continues to make investments in the development and extension of your mobile/digital...

October 2020 Wealth Access Release Notes

Wealth Access continues to make investments in the development and extension of your mobile/digital client experience and the advisor and firm tools that help drive insights and efficiencies in your organization.

This release will automatically take place on Monday, October 19th. Please note that several of these enhancements are configurable and will not alter your current configuration until you decide to enable them.

Product Updates

Data Infrastructure

We recognize the specific role we play in your data strategy by facilitating complete and transparent views into the financial lives of your clients. We are committed to serving in this capacity into the future with continued, focused product investment on enhancing our data infrastructure.

WHAT TO EXPECT IN THIS RELEASE?

- The enhancement will be applied to many (not all) held-away account connections

- Beginning on October 19th, clients linked to enhanced held-away account connections will be asked to re-authenticate to those accounts one-time to ensure they can take advantage of the improvements moving forward

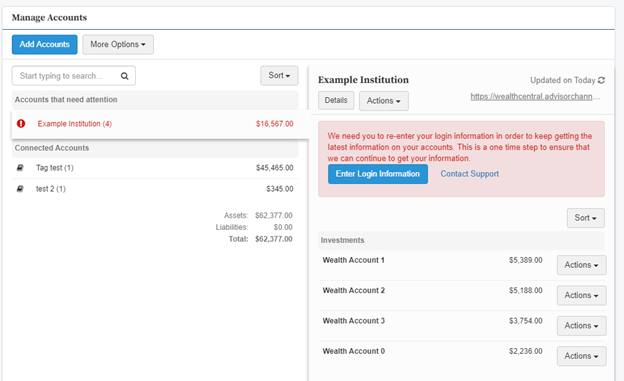

- Clients will be alerted that accounts need attention (see screen below)

- The system will take the clients through a workflow to re-authenticate to the accounts so they can re-sync through the enhanced user experience

- All account history will remain intact during this process

- Outside of the enhanced experience of managing held-away accounts, the user experience in Wealth Access will remain unchanged

- We ask that organizations encourage their clients to login to Wealth Access at least once between October 19th and November 6th (three weeks) to update their held-away account information

- NOTE: There are a few firms that will be introduced to this enhancement beginning October 26th and they have been notified in a separate email

Managed Accounts Screen Identifying Accounts Need Attention

Wealth Insights

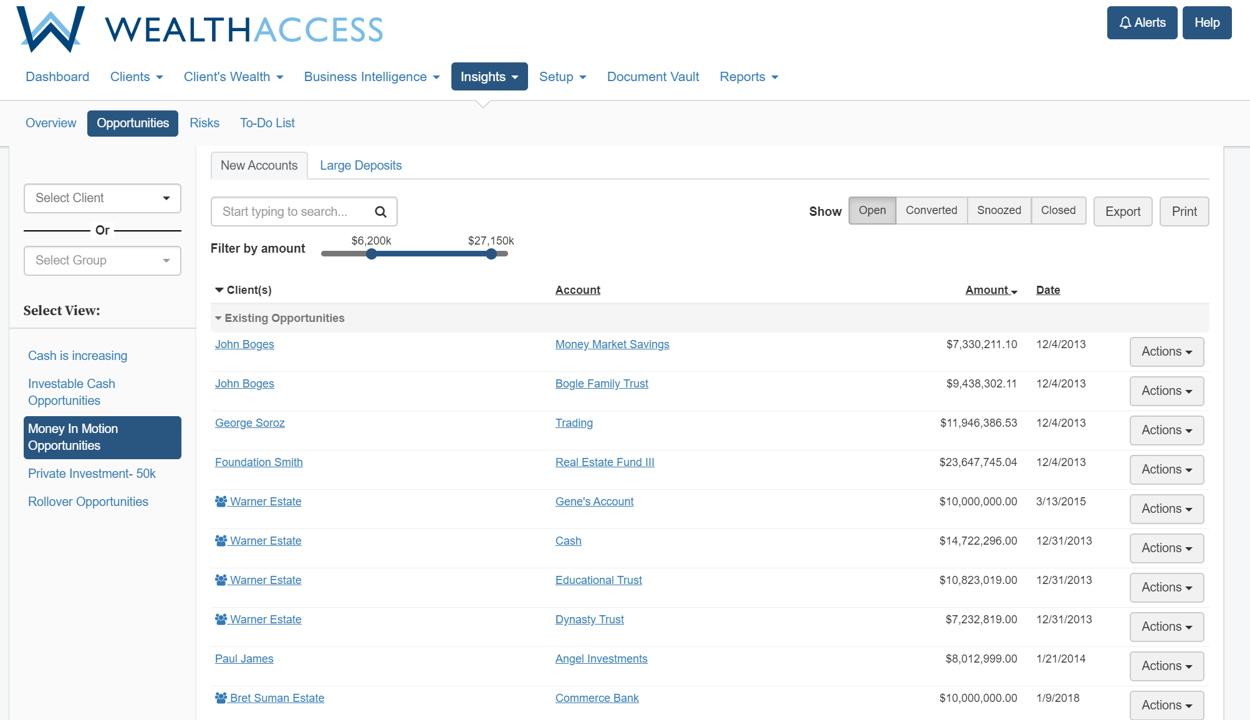

Wealth Insights proactively identifies opportunities, trends, and risks across your client base by applying business intelligence techniques across clients’ account data, login activity, and profile information. The insights are delivered through intuitive and easy-to-use dashboards so your firm executives, administrators and advisors can respond and take action to deliver a higher level of client satisfaction and to move additional assets from held-away to managed.

If your firm is interested in applying our business intelligence engine to proactively identify opportunities and risks across their set of clients, Wealth Insights is now generally available to client organizations that also subscribe to the Firm Insight module.

Advisor Opportunity Dashboardntion

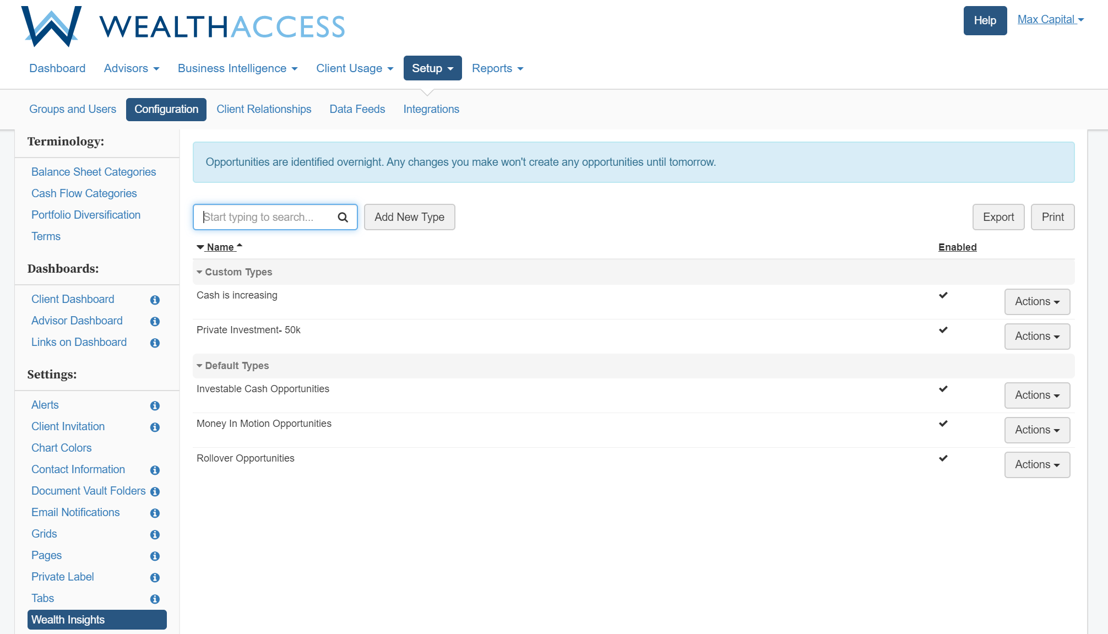

Configure Firm-level Opportunity Types

Data Infrastructure

Wealth Access Data Services

The Wealth Access platform runs on data and we are committed to continued investment in our data infrastructure to meet our clients’ growing needs.

Multi-faceted firms. We continue to ensure that we represent the entire financial picture that end clients have with your firm, by consolidating financial assets across trust, brokerage, wealth, retirement, banking, credit card, and insurance divisions at the household level.

Full balance sheet reporting. We are broadening the breath and depth of supported financial services institutions to ensure that your end clients have a single, financial dashboard, and also that your financial professionals have visibility into all of the clients’ financial assets.

Data aggregation. We are bringing more aggregation partners into our data aggregation as a service (DAAS) model to improve the accuracy and stability of held-away account data services.