Wealth Access continues to make investments in the development and extension of your mobile/digital...

October 2021 Wealth Access Release Notes

Wealth Access continues to make investments in the development and extension of our Customer Data Insights platform that Unifies and Enriches your client’s data to power hyper-personalized experiences for your clients and your organization.

This release will automatically take place on Saturday, October 16th. Please note that these enhancements are configurable and will not alter your current configuration until you decide to enable them.

Product Updates

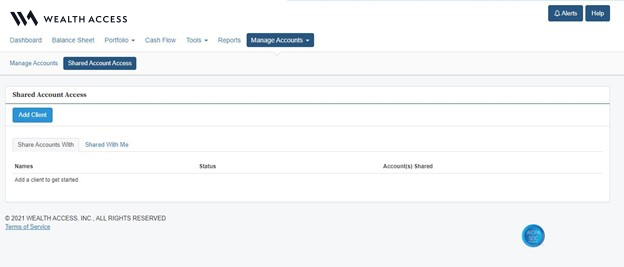

Shared Account Access

We recognize the specific role we play in delivering a hyper-personalized digital experience to your clients by enabling transparent, unified views into their complete, living balance sheet.

We are enhancing the client user experience by making it easier for clients to share accounts with one another. Through our new Shared Account Access module, we now allow clients to share specified accounts with other clients within your client firm.

If an individual has constructed her entire living balance sheet in Wealth Access, she can now easily share account views with her spouse, her children, or other individuals within your firm so the accounts can be displayed on the other individual’s balance sheet. We do ensure that the both parties are fully aware and approve the request to share accounts.

This capability can be enabled at the firm level through Wealth Access administration. If you are interested in learning more about this capability, please reach out to the Wealth Access Client Success team.

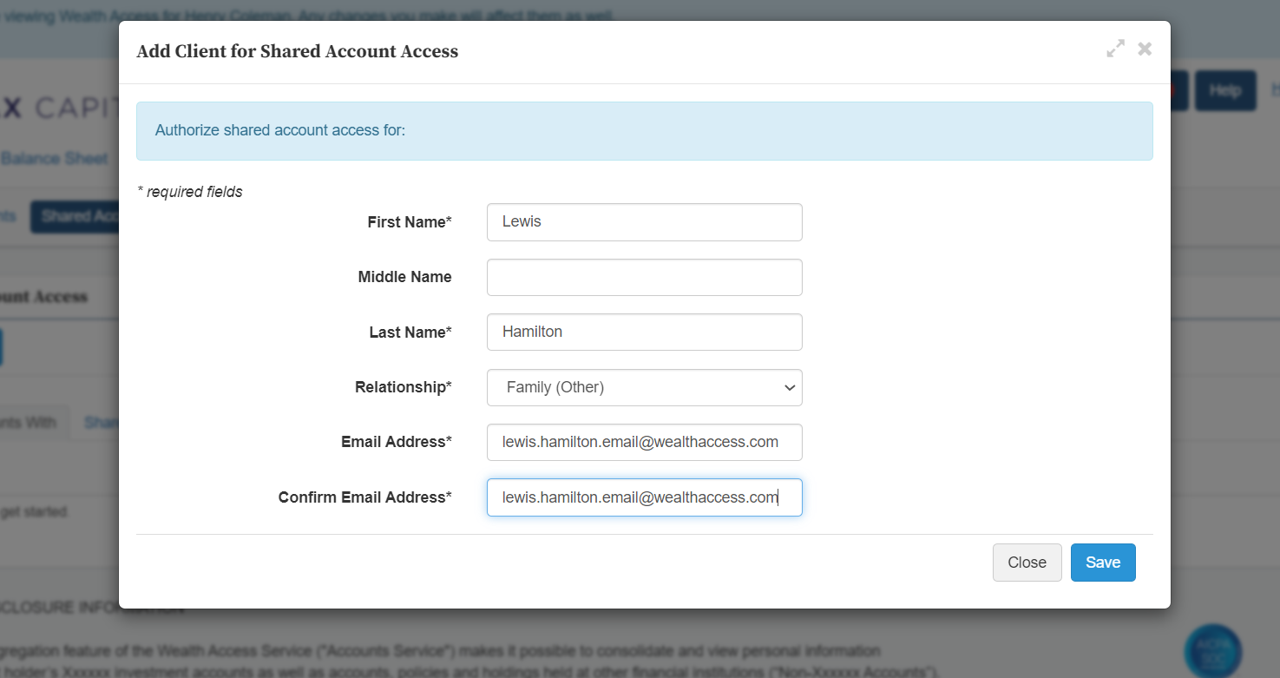

STEP 1: Client clicks ‘Add Client’ to identify individual to share accounts with.

STEP 2: Client fills out other individual’s information.

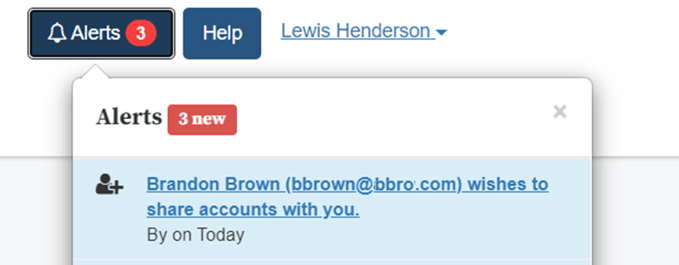

STEP 3: The other individual receives an in-app alert that a client wishes to share accounts with him/her.

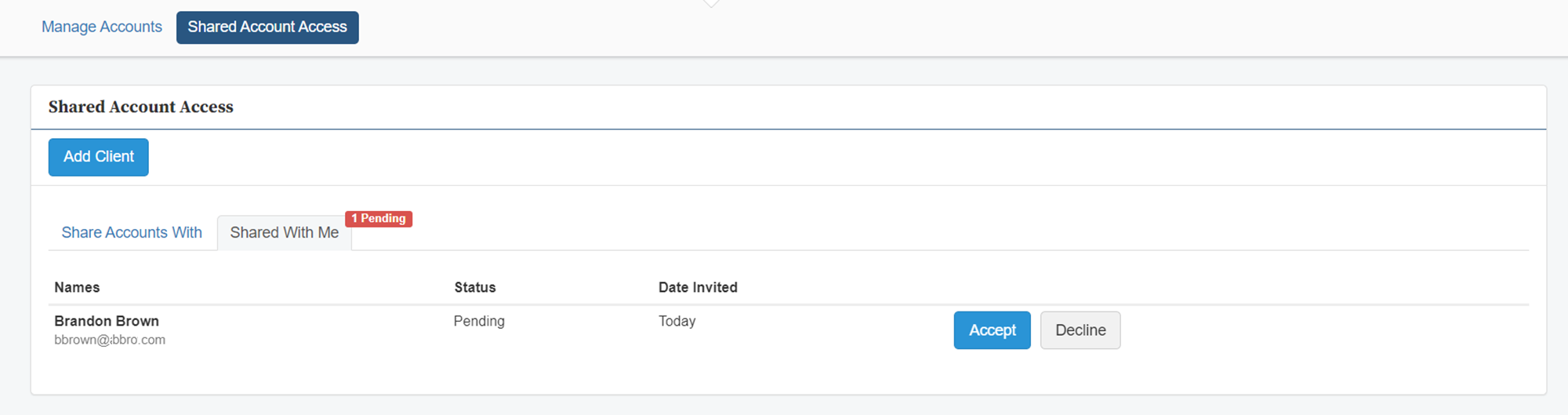

STEP 4: The individual accepts the request for the client to share accounts with him/her.

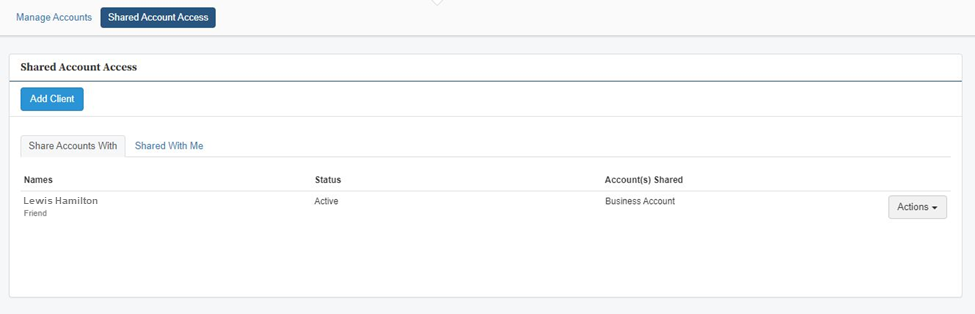

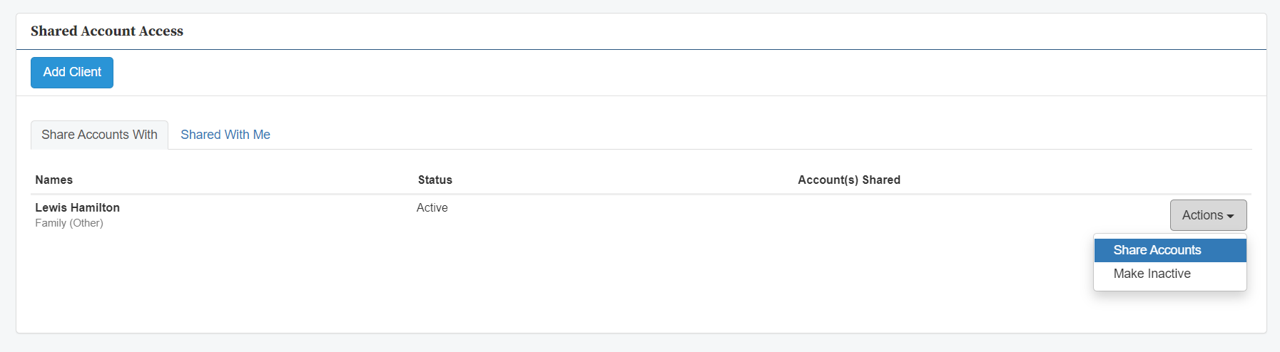

STEP 5: The initial client can now share accounts with the selected individual.

STEP 6: The client proceeds through a workflow to select accounts, acknowledge a disclosure, and review & submit.

STEP 7: Accounts have been successfully shared and are now viewable by the other individual.

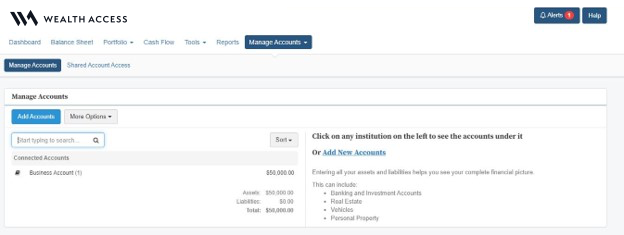

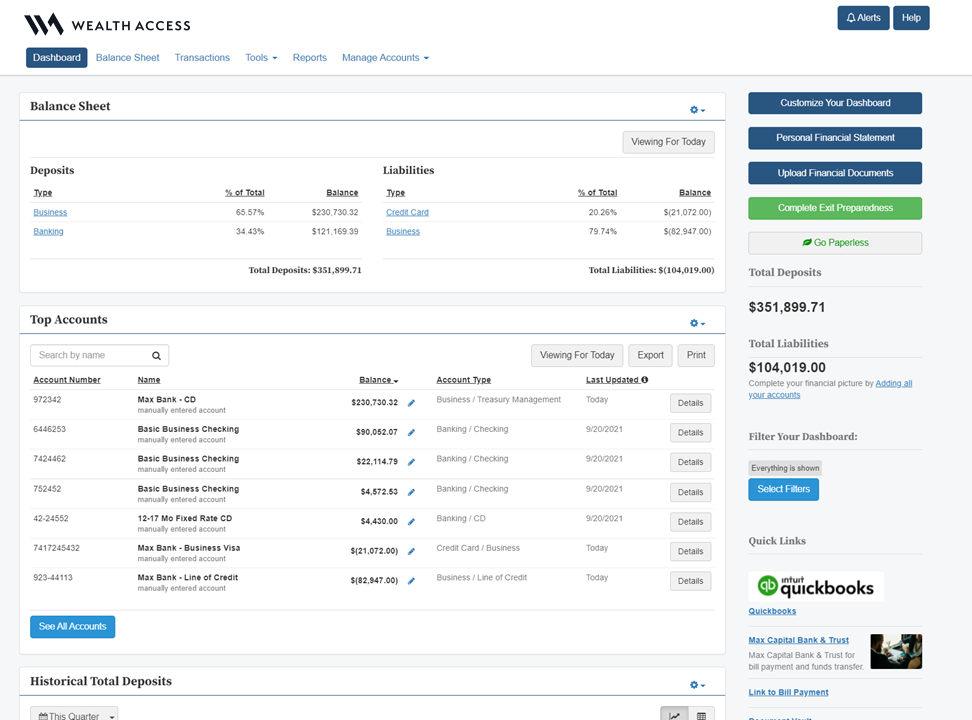

Digital Banking

Our Digital Banking initiative is focused on allowing our enterprise firms to represent complete, enriched financial views for clients and prospects – retail + wealth + business + external – within their retail, digital banking experience. By acting as the customer data unification platform for these enterprises, Wealth Access ensures that any account information collected can be presented throughout the customer omnichannel, digital experience.

Wealth Access understands that enterprises have other digital assets, and we offer a non-invasive, open architecture system that can present the unified customer data in any digital experience hosted by the enterprise.

Our Digital Banking integration is centered on the following key areas:

- Establishing direct bank data feeds with the enterprise

- Open data and widget API architecture to digitally present unified customer financial views with other bank digital user experiences

- Single sign-on between applications to improve the customer experience

- Enriched data capabilities to automatically categorize bank transactions

Wealth Access for CRM

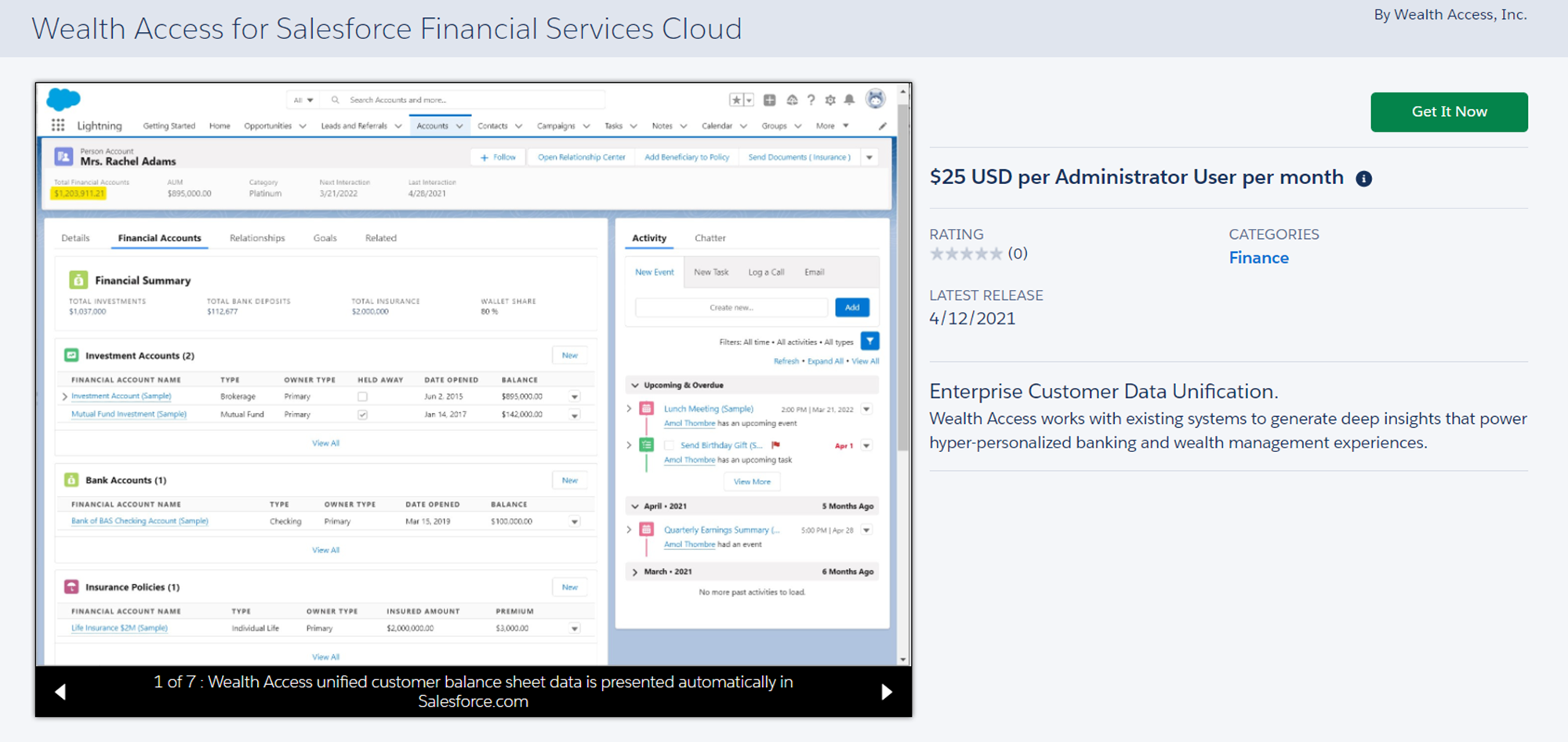

Wealth Access for Salesforce Financial Services Cloud — IS LIVE!!

A CRM system is often the primary user experience for financial professionals, especially individuals that lead in the front-end of the client journey. With Wealth Access representing the living balance sheet for all of your clients, our Wealth Access for CRM initiative will enhance your CRM experience by enabling transparent views into the financial balance sheet of clients and prospects.

We are excited to announce that our new app, Wealth Access for Salesforce Financial Services Cloud, is live in the Salesforce.com AppExchange.

Through seamless data integration between Wealth Access and Salesforce.com, financial account-level information of a firm’s set of clients will flow nightly into the Financial Services Cloud (FSC) data store and made available across object records in Salesforce.com.

Wealth Access for Salesforce Financial Services Cloud

Coming Soon

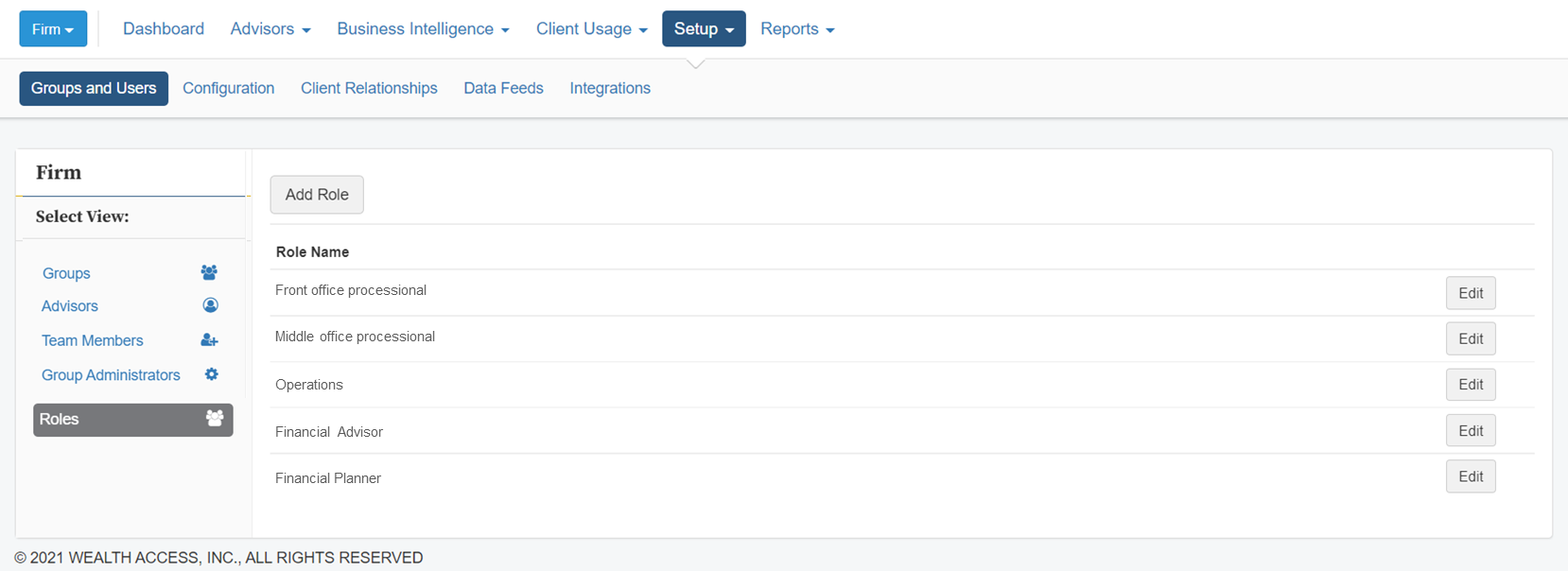

Roles-based Hierarchy

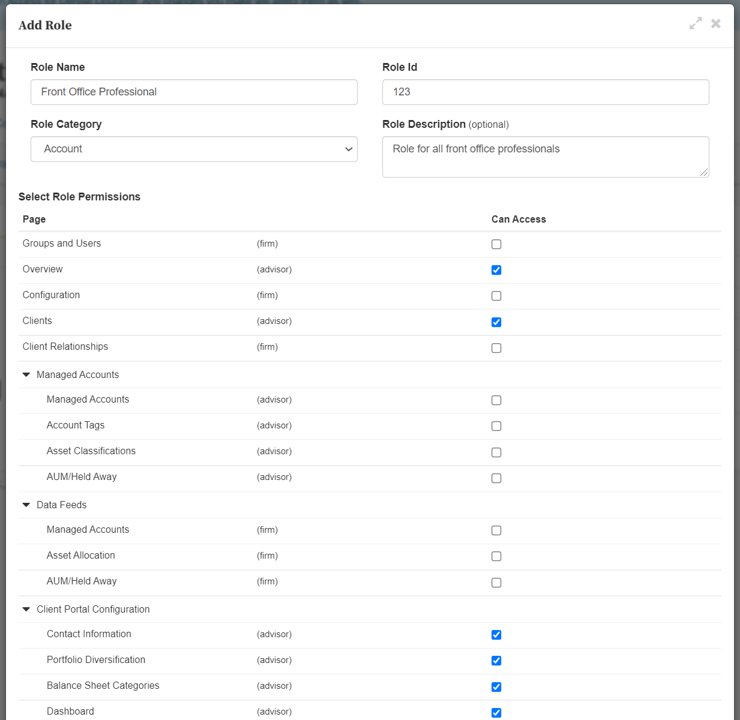

We are excited to introduce a new permissioning structure in Wealth Access where firms can expand on the number of user roles (financial advisor, front office professional, middle office professional, financial planner) in the system and have functional entitlements determined by the specific role.

Today, we have 3 base roles — firm administrator, team member, and advisor. If a firm desires to establish different functional entitlements for different employee advisors, those updates have to be made at the user level.

With this enhancement, firm administrators can now establish new roles and specify what users can or cannot do at that role. As firms onboard new employees, there will be much added benefit to simply assign the employee to a specific role and have Wealth Access functional authorizations determined by the specific role.

Create New Role under ‘Roles’ Page in Setup

Select Permissions for New Role

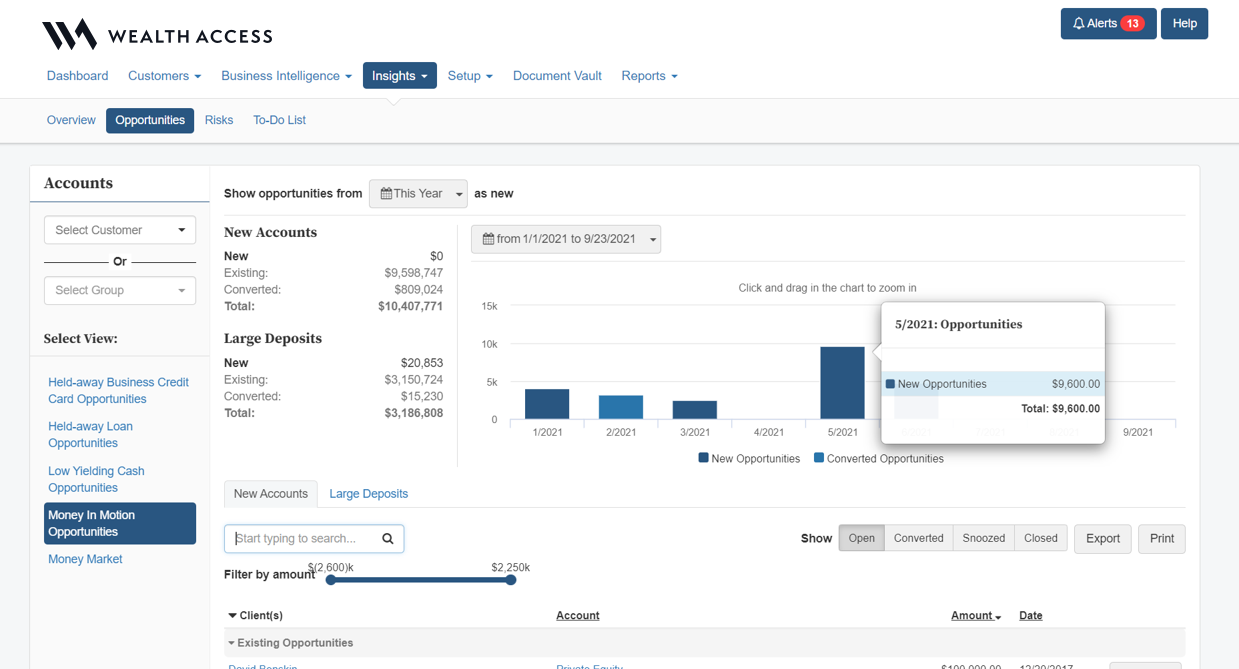

Wealth Access for Business

With over 30 million business owners in the US, business banking is a highly desirable client segment for our multi-faceted, enterprise clients. This segment brings high income, sizable portfolio opportunities for wealth advisors to manage and grow AUM, with future opportunities centered on liquidity events as businesses are transitioned to new owners.

Wealth Access for Business is centered on allowing our enterprise firms to capitalize on the small, medium size business (SMB) client segment. Through the enablement of key digital technology, Business Access looks to drive increased efficiency within business banking for client communication, data collection and insights, and bi-directional document sharing between business bankers and business owners.

Business Owner Hub

Business Insights for the Business Banker

Data Infrastructure

Wealth Access Data Services

The Wealth Access platform runs on data and we are committed to continued investment in our data infrastructure to meet our clients’ growing needs. We have a flexible, non-invasive enterprise platform that can sit on top of existing systems across disparate, legacy data sources from all business lines. We collect, rationalize, and enrich data from those sources and display it at the customer, employee, and firm levels.

NEW UPDATES

SEI Direct Data Feed. We have enabled a new, direct data feed with SEI to consume core accounting data from their wealth platform. Please contact us if you are interested in enabling a direct data feed for your SEI accounts.

About Us

Wealth Access is an enterprise customer data unification and enrichment platform that works with financial services’ existing books and records to generate deep insights that power hyper-personalized banking and wealth management experiences. By intelligently unifying records across multiple systems, Wealth Access creates living balance sheets that enable service teams to see each client’s complete financial story and work across business lines to improve customer loyalty and drive higher revenue. As a result of its innovative enterprise-class solutions, Wealth Access today supports more than 200 customers with over $570 billion in assets on the company’s platform, including several of the largest RIAs and banks in America.