Wealth Access continues to make investments in the development and extension of our Customer Data...

December 2022 Release Notes and Product Enhancements

We are excited to share our final release notes of the year and provide a glimpse of upcoming enhancements our team has been working on.

In this quarter’s Product Update, we’re making it easier than ever to share your financial data, connect to the tools you and your clients need, explore data insights, increase your security, and so much more.

Please note that these enhancements are configurable and will not alter your current configuration until you decide to enable them. The items in this release are deployed Saturday, December 10th for users that subscribe to the applicable service offering.

For even more information on the new updates, click here to register for the release overview on December 6th.

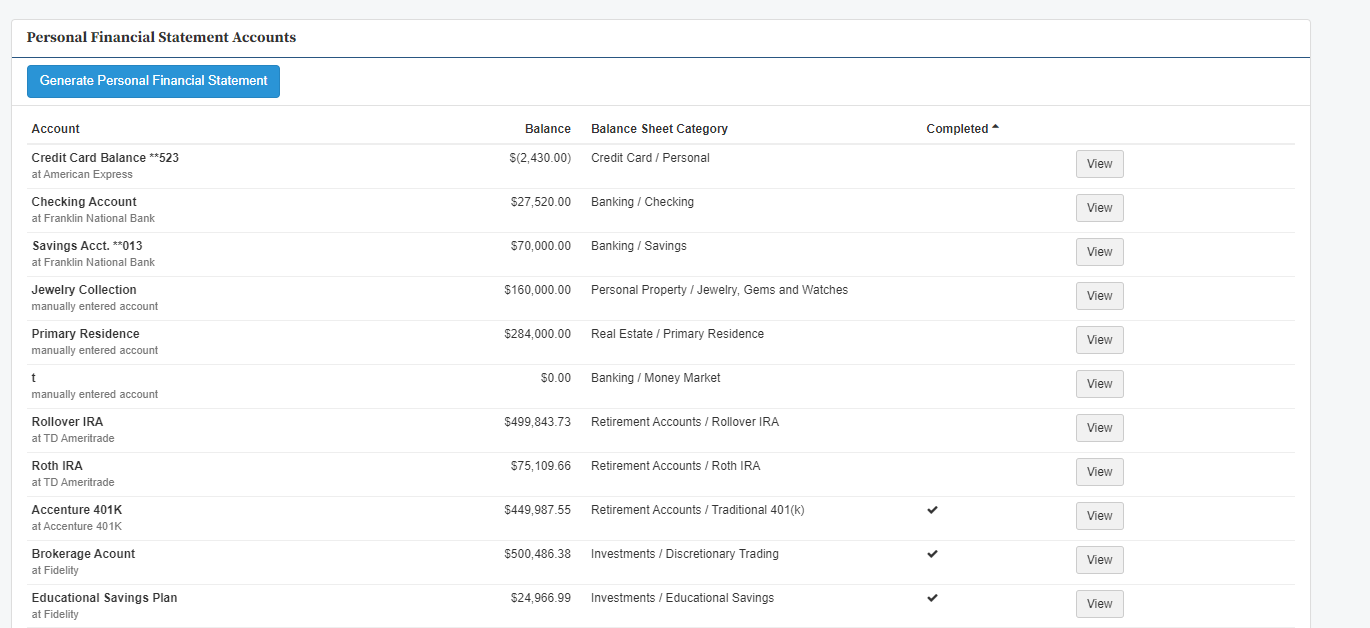

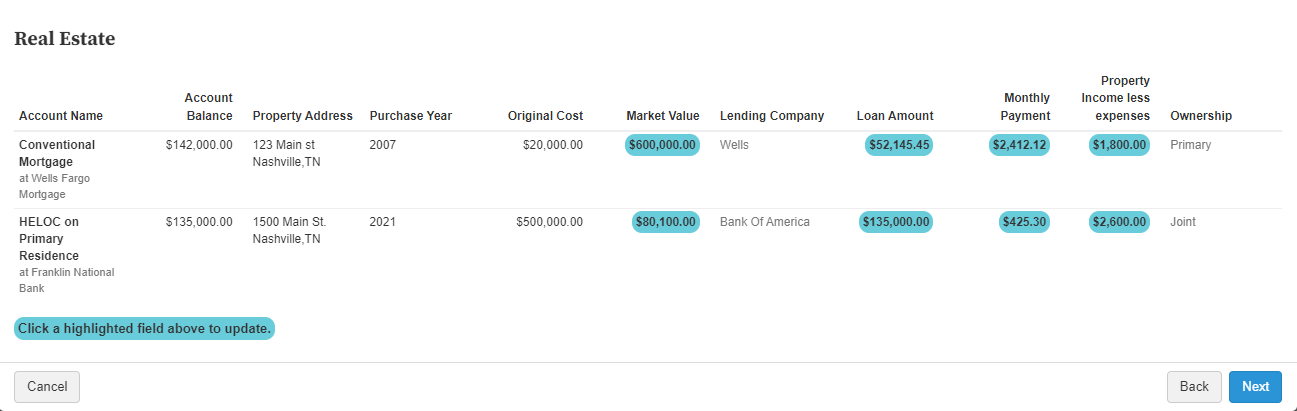

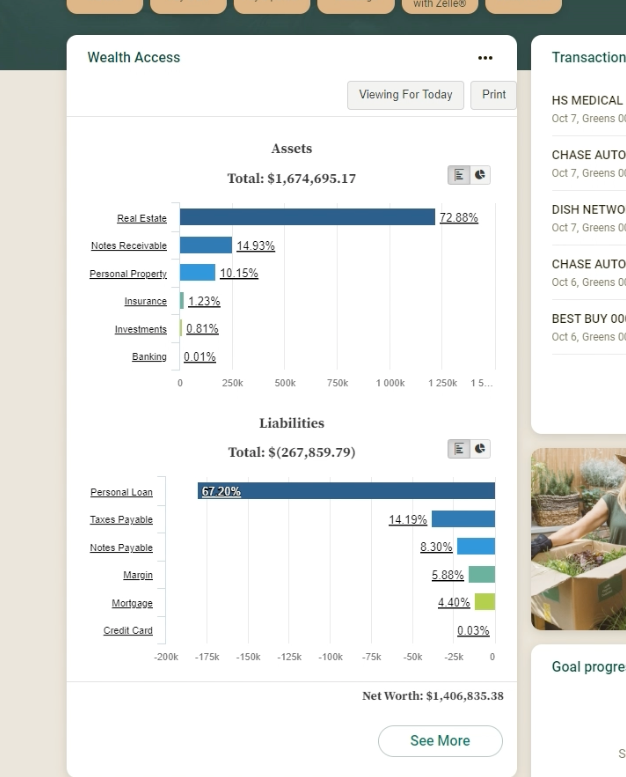

Enhanced Personal Financial Statement

The enhanced Personal Financial Statement modernizes the way financial institutions request and receive personal financial statements from their clients. The manual processes of managing spreadsheets and PDFs are being digitized and streamlined for both cost and time efficiency.

This new feature will provide business, retail, and wealth clients the ability to create, store, and share their personal financial statements with your institution for any manner of credit needs – enabling Wealth and Banking teams to focus on high value interactions and opportunities.

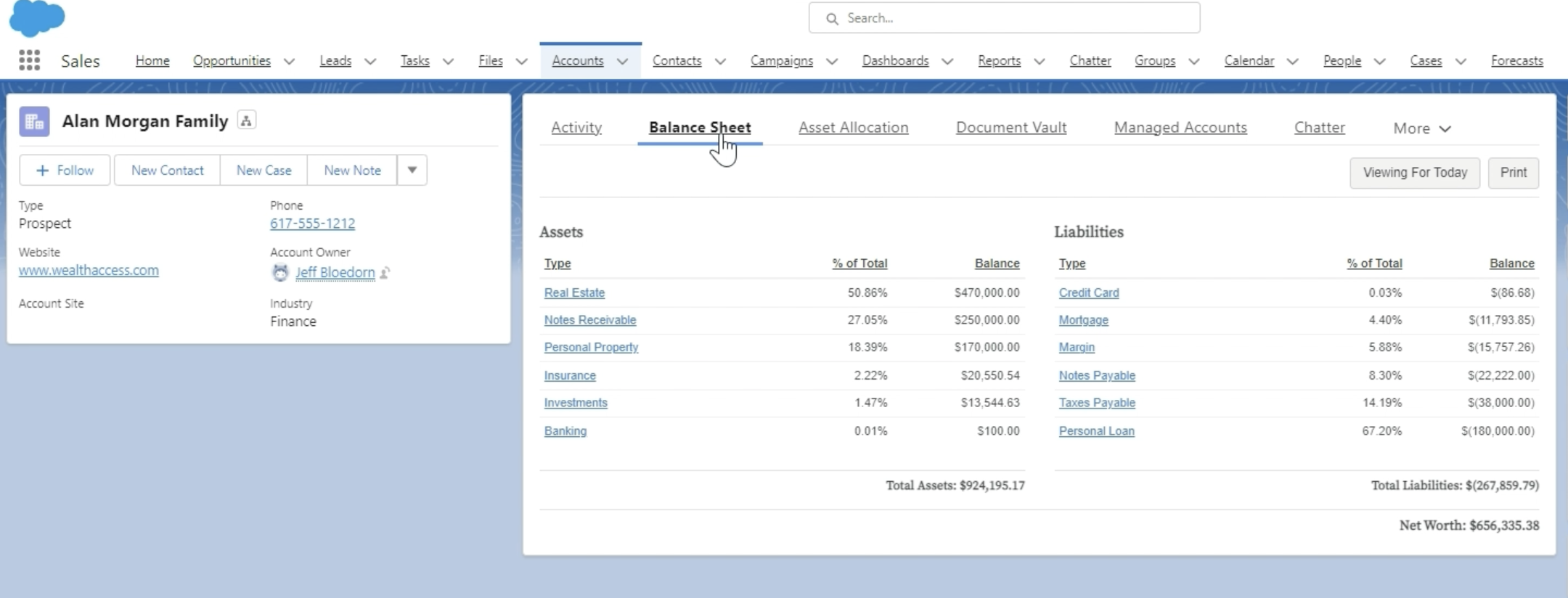

Salesforce

Wealth Access widgets operate directly within the Salesforce experience, giving your team easy access and simple implementation.

We have created new widgets for additional roles within Salesforce, making it easy for more of your team to gain access to actionable insights and pursue opportunities.

Security

We continue to invest in data security protocols to ensure we exceed expectations regarding data security and privacy. We are underway with a SOC 2 audit in addition to our previous tests and audits.

Performance

We continue to enhance performance with ongoing infrastructure and database improvements to allow our client firms to scale their digital experience alongside their business with optimized performance. An internal dashboard has been established for reporting overall database utilization metrics.

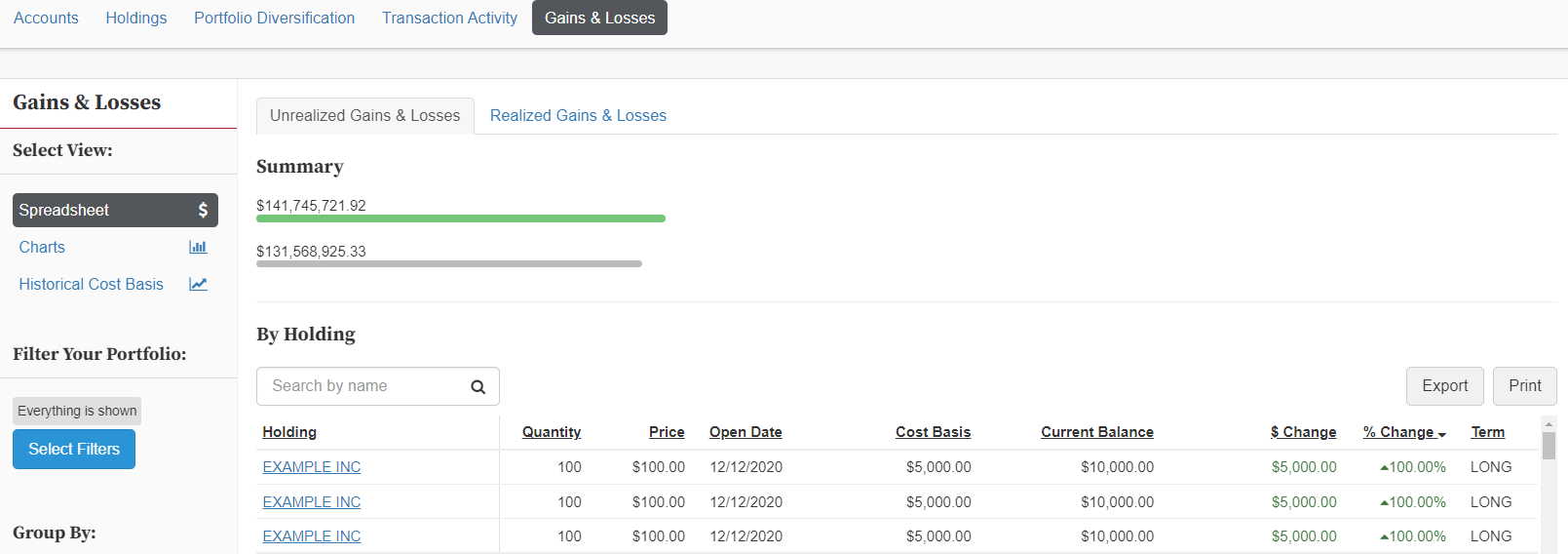

Tax lot reporting

We now have the ability to consume Fidelity tax lot files, which can be used to take advantage of our Gains & Losses feature.

Integration Enhancements

Q2 Digital Banking Widgets and Single Sign-On

Q2 Digital Banking widgets create end-to-end banking and lending experiences to transform financial experiences from every perspective.

As a bonus, our wealth and personal financial management widgets can now be integrated within the Q2 digital banking experience for a seamless client experience. Click here for an in-depth look at our widgets integrated within a digital banking experience.

In addition to our widget integrations, you’ll now have the capability of configuring single sign-on from Q2 into the Wealth Access platform.

NCR DI Digital Banking Single Sign-On

NCR provides more than 15,000 community banks and credit unions with a wide array of digital solutions.

To improve Wealth Access’ user experience, we now have the capability of configuring single sign-on from NCR DI Digital Banking to the Wealth Access platform.

Data Feed Enhancements

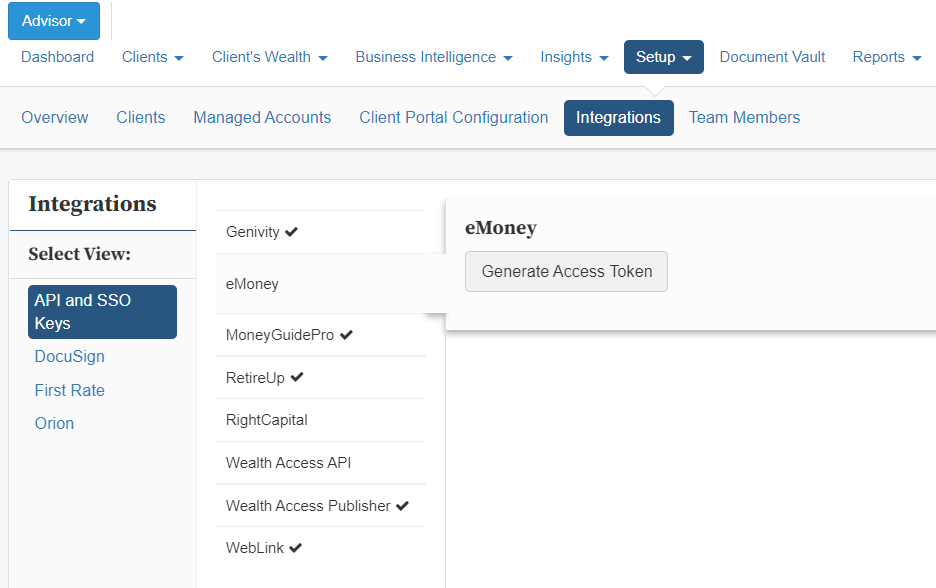

eMoney

EMoney offers planning-led solutions that enable advisors to manage their practice efficiently and effectively.

With this latest product update, you’ll now have the capability of sending managed and held-away account data to eMoney. This integration removes the need for manual entry so advisors can focus on providing a better financial planning experience for clients.

FIS Relius

Relius provides recordkeeping and administrative solutions for employee benefit professionals in the retirement plan sector.

We have expanded our integration capabilities to enable a direct data feed from FIS Relius to the Wealth Access platform for retirement plan holdings and transaction data.

Stellar

Stellar is a provider of philanthropic fiduciary enterprise solutions and professional services.

Account data information can be made available in Wealth Access to facilitate full aggregated, balance sheet reporting for clients.

GreenHill Performance Statements

GreenHill helps wealth management companies focus on what they do best by becoming your performance measurement partner.

We are now able to receive and automatically store GreenHill performance statements for clients to access in our secure document vault.

FiTek Statements

Fi-Tek provides trust accounting, hedge fund administration, and wealth management software solutions to the financial services industry.

Wealth Access is now able to receive and store FiTek statements for clients to access in our secure document vault.

Coming Soon

Actionable Insights

Our team is working to bring more actionable insights to empower your banking teams to best serve small business owners.

Multi-factor Authentication

We are working to increase the amount of security options available to clients.

Enhanced Estates

Our estates feature will be streamlined with new workflows to assist financial professionals managing generational wealth.

Open Banking

More open banking connections are on the way to make accessing data faster, while also making it more secure and reliable.

Learn More About Wealth Access

Want to discover more ways Wealth Access’ updates can make your bank more efficient? Click here to connect with a Wealth Access team member and schedule your free demo today.