Salesforce is, far and away, the most popular CRM software in the business world, with a market...

What is Wealth Access for Business Owners and How Does it Work?

Meet Lisa.

Lisa owns a specialty doughnut shop and has 15 employees. When COVID hit, her business was all but forced to shut down. No one was coming in – employees or customers – but she still had to pay rent and keep going.

It was pretty touch-and-go for a while, but thankfully her banker stepped in and helped her get a PPP loan so she could make payroll and stabilize her business until things smoothed out.

As a financial professional, you likely know Lisa’s story all too well. Your clients couldn’t come into the office. Virtual meetings (and signatures) became the norm overnight.

Life changed completely.

Lisa is not unique – the 30 million other small business owners in our country are the backbone of the American economy.

Not only are small business owners important to our economy, they are also one of the most important client segments for financial institutions across the country.

Whether you’re a business banker or wealth advisor, your ability to give the best advice to these highly cherished clients depends on you knowing what they are going through so you can help them – both in their professional and personal lives.

Wealth Access for Business Owners

That’s why we built Wealth Access for Business Owners – to simplify the already complex lives of business owners and to help financial professionals become their trusted advisors, not just money managers.

Wealth Access for Business Owners is built on roles-based experiences so everyone involved in the relationship gets the insights they need for success.

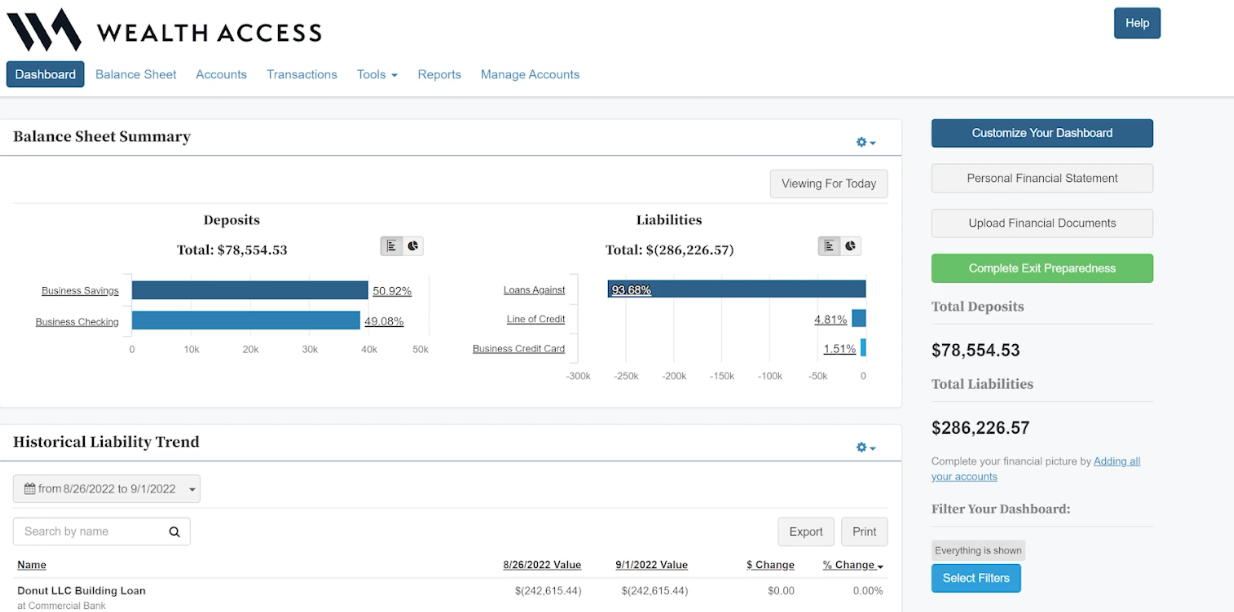

For business owners, being able to manage their personal and business finances in one spot is a game changer by adding a layer of simplicity to their already complex lives. They can see their entire financial relationship with your institution, in addition to all held-away assets, giving them a complete financial picture on their computer or phone.

Wealth Access gives your clients direct access to their cash flow, spending behaviors, financial planning status, as well as two-way sharing of important docs through the Document Vault.

And it doesn’t stop there.

How Wealth Access for Business Owners Helps Advisors See Clients’ Full Financial Picture

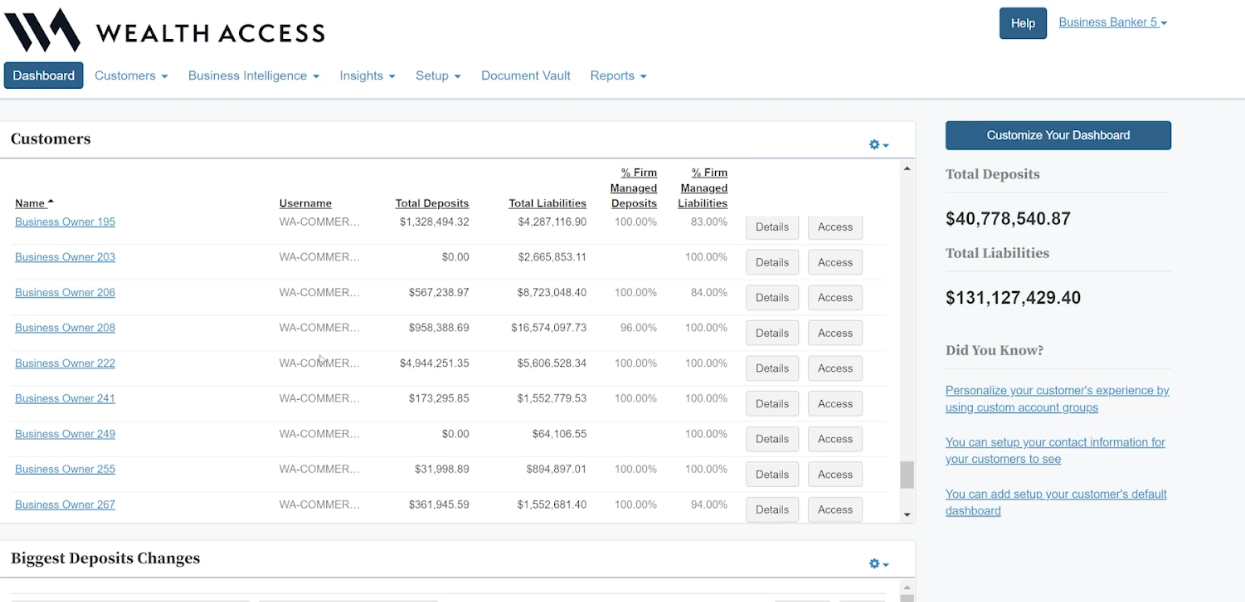

In addition to providing customers the highly desired 360-degree view of their financial activities, Wealth Access for Business Owners enables your team to see the information as well, allowing you to manage your books of business in one simple, efficient view so you can have more insightful conversations with your clients. Rather than jumping from system to system to hunt down the pieces of a client’s financial puzzle, it’s all in one place.

By connecting all of a client’s data – professional and personal – Wealth Access for Business Owners helps you establish relationships across your entire enterprise. When a business owner prepares to sell their business, you’re already there to help them manage the assets from the sale. Wealth Access for Business Owners helps identify cross-sell opportunities.

With increased efficiency, complete data and customized dashboards, your team can spend more time enhancing client relationships and building trust, and less time tracking down numbers.

Between their personal and professional lives, business owners are some of the busiest people you will ever meet – and they are some of the most eager prospects, too. They need someone who can help them save time and streamline their financial life.

Wealth Access for Business Owners provides the tools to help you be the trusted advisor that small business owners need. By bringing everything together, you can give them more time to focus on what matters: making their business thrive.

Request a Demo of Wealth Access for Business Owners

Click here to schedule a time to see Wealth Access for Business Owners up close and personal.