Investors today are demanding a much more rich and interactive online experience from their...

Improve Your Bank’s Customer Experience with Transaction Enrichment

The first step to keeping your bank’s customers happy? Providing a smooth and simple digital experience. In 2020, nearly 2 billion bank customers were actively using online banking services, with that number predicted to continue trending upward in the coming years.

Consumers want real time data in an easily accessible and visually appealing platform – and the key is in how well your bank leverages transaction enrichment.

What is Transaction Enrichment?

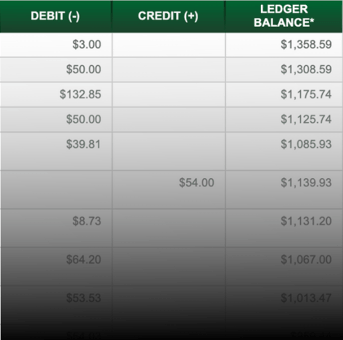

So what is transaction enrichment? Well, if you’ve spent much time looking at any data feed, you know that the raw data can be pretty confusing.

That’s where transaction enrichment comes in: it’s the ability that Wealth Access provides to banks to enhance and polish that data. Transaction enrichment turns all those raw numbers into useful and actionable information in a clear, easy to understand view.

Transaction enrichment works by cleaning the data – it categorizes and classifies information from multiple sources in one place, providing an end product that’s useful for your bank’s clients as well as the people on your team who serve them.

4 Ways Transaction Enrichment Improves the Client Experience

Transaction enrichment is all about creating a better client experience. From stronger security measures to better financial insights, transaction enrichment delivers several benefits.

1. It Allows Banks to Raise the Bar on the Service They Provide

The better a financial institution understands its clients, the better advice they can provide. The more you know, the more you can grow.

One of the simplest but also most time-consuming ways to improve a client’s financial plan is to track exactly where they’ve been spending their money. It’s too easy to swipe a debit card or sign up for a subscription and then forget about it. Maybe Netflix is a necessity, but that Ancestry account they signed up for a year ago and never logged into again? That could probably be nixed.

Over time, little recurring costs can really add up. Oftentimes, clients themselves only have a vague idea of where much of their hard-earned money is going.

That’s why tracking expenses is such a valuable tool for financial professionals – it allows them to provide enriched data as part of their counseling initiatives and enables them to proactively add more value to their clients. With transaction enrichment, financial planners can not only show clients where they could save money, but also potentially provide the exact dollar amounts they’d be saving.

2. It Turns Raw Data into Usable Information

Nobody wants to look at an empty pie chart on their bank’s website.

It’s tough to manage expenses, accumulate savings and change spending habits when all you have to look at is an endless list of raw data.

Transaction enrichment turns raw data into useful information, categorizing debits and credits into a story of your customers’ financial lives. Where they spend money, where they overspend, where they could spend more – it doesn’t end.

When your clients can visualize that data in a fully colorized and automatically categorized chart, they can make better, more informed decisions.

3. It Provides an Additional Layer of Protection from Fraud

It’s important for customers to keep a close eye on their bank account transactions to help prevent fraud and minimize losses.

Many clients don’t realize that the sooner they report suspicious or fraudulent activity, the less likely they are to end up losing money. In cases where suspected theft is reported to the bank within two business days, the Federal Trade Commission (FTC) caps the client’s personal maximum loss at only $50. After those two business days, clients could end up personally liable for any stolen funds.

Providing a useful interface that your clients use frequently gives them another opportunity to see any red flags before it’s too late.

4. It Gives Advisors the Full Picture

Financial planners need to be able to gather data and see exactly where clients’ money is going to help create and reach financial goals. But even though gathering information on clients’ spending habits is a necessary part of the job – that doesn’t mean it’s always easy. From awkward conversations to missing information, gaining a full picture of a client’s spending habits can be tough.

With transaction enrichment, those conversations are quick and easy, and the advisors can provide actionable insights based on their clients’ real spending habits. Both the advisor and the client are equipped to achieve their long-term goals.

How You Can Start Simplifying Transaction Enrichment for Your Team and Your Clients

So how does Wealth Access’ transaction enrichment work? It’s surprisingly simple.

In order to get transaction enrichment, banks provide our light-touch software with a direct data feed. We then normalize the data through an enrichment process and send it right back for display. The cleaned data is then available to clients through a colorful visualization, and also to your bank’s team for analytics purposes.

The entire process of unifying your data is quick, easy and secure – providing your clients with a hyper-personalized experience in just a few clicks.

Enrich Your Transactional Data with Wealth Access

The more information you can provide your customers, the better you can help them to plan and organize their finances. Wealth Access’ light-touch data unification platform can transform your customers’ data into unified and hyper-personalized visuals, driving deeper insights and delivering better results every single time. Ready to see Wealth Access in action? Request a demo today.