Salesforce is, far and away, the most popular CRM software in the business world, with a market...

Why Data Ruled the 2022 Wealth Access Summit

What do you get when you bring 30 of the country’s top regional and super-regional banks together for a full day of discussion about technology, operations, and growth strategies?

You get the 2022 Wealth Access Summit! Plus, a whole lot of ideas for how to make digital banking experiences better for consumers all around the United States.

In late April, we were thrilled to welcome so many influential people from hyper-growth focused banking organizations to Nashville. We wanted to create an environment where they felt free to share ideas and strategies with each other behind closed doors, where reciprocation and transparency were paramount.

Because it was a “closed doors” event, we won’t get into all the specifics, but we do want to give you a few highlights and takeaways so your firm can also be in the loop for how you can improve innovation and growth in your bank or wealth management firm – and ultimately, realize new revenues as a result.

How Bank Organizations Innovate and Grow

While most conferences focus on thought leadership, the Wealth Access Summit is an event geared towards action. In fact, we like to think of it more like a growth conference where executives and other banking leaders can learn from each other and take away ideas for improving their operations, while also innovating to grow at a faster clip.

We brought in a veteran moderator, Doug Fritz, co-founder and CEO of F2 Strategy, to lead discussion. Doug and his team kept discussion on point and focused on the Summit’s key themes:

- Unlocking new revenue through technology

- Aligning business lines with technology solutions

- How technology supports decision making

- How data ownership creates operational efficiencies

- Improving the advisor and client digital experience

- Keeping up with client expectations

If we were to pick a key theme that influenced every discussion, it would be the importance of data ownership. While financial institutions are familiar with the need to integrate their tech systems, the next step is to unify data through a central system and keep all their books and records consistent and comprehensive.

When that step is done, the dream of 360 degree financial views for customers finally becomes possible — as many of the attending firms could attest.

Technology Choice is Key

A common conversation between attendees was about the technology partners they chose to partner with to build both their internal and external digital experiences.

One popular conversation that came up centered around this question: Whose client portal should you use?

It’s a common concern given how many solutions providers offer a Client Portal. Thankfully, there’s no competition here for clients of Wealth Access. Instead of building against other platform providers, we choose to build with them at Wealth Access.

Whether an organization is better served by using a client portal from another provider or the Wealth Access client portal is a decision each firm should make — and one we’re happy to consult with them on.

With the API functionality shared by Wealth Access, banking organizations can provide complete financial views across commercial, business, and personal banking lines with no loss of data or need to weigh down their customers with multiple logins.

We don’t believe that any financial institution should feel like their data is being held hostage, and with our platform built on open APIs, they won’t ever have to deal with the issue of inaccessible data.

The 5 Big Takeaways from Wealth Access Summit

While we were thankful for the opportunity to share our latest innovations and product roadmap, the most valuable takeaways on our end came from spending hours just listening to the clients, participants and partners who shared their experiences and ideas.

It was an enlightening, eye-opening experience for everyone involved. As one attendee put it after hearing about our innovations over the last year: “We have to reimagine how we use Wealth Access, because there is a lot more than what we’re using right now.”

To that end, here are the five biggest takeaways from the Summit:

1. Open Banking is the Future of Growth

Open banking makes access data faster, while also making it more secure and reliable.

So far this year, we have partnered with some of the biggest financial institutions in the country (like Citibank, Chase, and Wells Fargo) to help provide our clients with complete financial pictures, and we’re just getting started.

“Open Banking has significantly increased clients’ data security and our ability to share information with customers,” said Sal Marone, Chief Administrative Officer of Fulton Bank/Fulton Financial Advisors. “Our digital client experience has taken a dramatic step in the right direction and the Wealth Access Client Portal, and ability to learn from other how other banks like ours are deploying the technology, is a big reason why.”

2. Digital Banking Initiative

Our digital banking initiative is focused on allowing enterprise firms to represent complete, enriched financial views for clients and prospects (retail + wealth + business + external) within their retail, digital banking experience.

Our digital banking integration centers on the following key areas:

- Establishing direct bank data feeds with the enterprise

- Open data and widget API architecture to digitally present unified customer financial views with other bank digital user experiences

- Single sign-on between applications to improve the customer experience

- Enriched data capabilities to automatically categorize bank transactions

“Working with Wealth Access we have created a consistent experience when clients log in through on-line banking or wealth. They can view their wealth along with banking or banking along with wealth,” said Troy Jordan, Managing Director, INTRUST Bank. “By creating this seamless experience, our wealth management business can expand faster by being right in front of consumer banking clients at any time.”

3. Commercial Banking

Our innovations in commercial banking do a lot of the heavy lifting when it comes to providing your institution (and your customers) with an individual’s complete financial picture.

As they say, a picture is worth a thousand words, so we’ll show it to you.

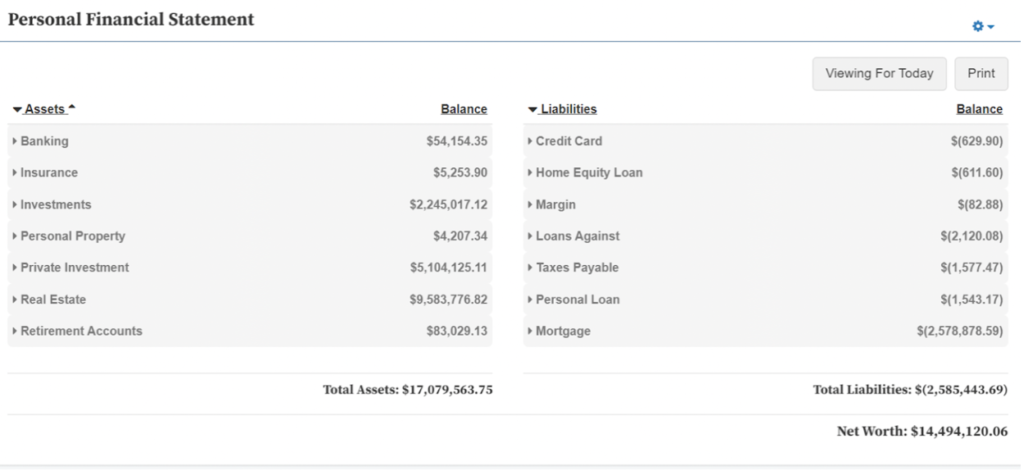

Personal Financial Statement

A personal financial statement allows your clients to see their entire financial picture quickly and at-a-glance. From any type of asset to any type of liability, it brings everything together into a cohesive whole.

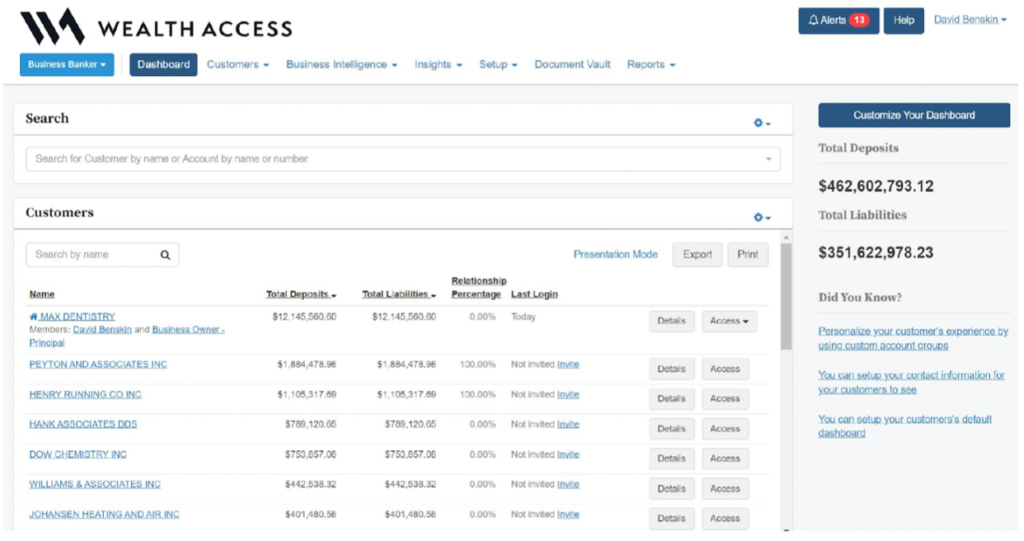

Business Banking Views

Similarly, the Business Banking View makes it simple for your team members to see across your customer base and understand how much of the relationship your institution owns – so you can know exactly who can benefit most from your services.

“Wealth Access is our center channel that enables us to capture what is within our four walls. It is the unifying force that aligns our commercial banking line with our wealth management division and more, pulling all of our disparate systems together. It creates a single pane of glass experience both at the advisor as well as client levels,” said Michael Wilson, Managing Director of Wealth Management, First Citizens Bank.

4. Securities-based Lending

Securities-based lending is a new partnership that we haven’t even officially announced yet – keep an eye out for an official announcement coming soon!

For now, we’ll just say that SBL is a line of credit collateralized by investment portfolios that provides clients liquidity to finance what they can already afford in a more efficient way.

It’s a win-win-win for clients, advisors and institutions alike, providing better insights and new revenue opportunities.

“Wealth Access understands the unparalleled importance of data like few other technology firms do,” said Tao Haung, Founder and CEO of Supernova. “Our collaboration is bringing democratized access to securities-based lending technologies for banks in a way that has never been done before.”

5. Salesforce

What we have learned from our clients is that Salesforce is underutilized, and especially among bank affiliated clients it may not have been designed for their wealth operations.

Where Salesforce excels, though, in how firms are able to create a personalized and fully branded client experience including a unified view of their wealth and banking. In addition, the end client can aggregate their total balance sheet.

This data then is integrated with Salesforce for advisors to get the right information, and start conversations that matter.

Last October, we announced Wealth Access for Salesforce. Unify all of your systems, books and records, and applications with Wealth Access, then incorporate your enriched data into the Salesforce CRM’s AI tools for the ultimate business analytics.

“An advisor can look at a holistic view and give much better advice,” said Scott Neff, President and Chief Executive Officer of Glenview Trust Company. “We had our client data in the CRM, but Wealth Access gets the rest of the data in there so we can really include it in everything that we do.”

To make it even easier for banks, Wealth Access has expanded our API endpoints for firms to select specific widgets associated with client records like their balance sheet, digital vault in Insights or the entire application based on roles within the firm.

6. Bank Expansion into the RIA Market

A final takeaway from the Summit was one that might surprise you if you aren’t keeping track of trends within the overall wealth management industry.

The banks attending the Summit made it clear, though, that they’re looking for ways to expand into the RIA market and provide comprehensive financial advice and investment management for their consumers in a one-stop-shop format through their institutions.

“We had a very aggressive launch timeline and wanted to choose a technology partner who could match the speed with which we want to operate,” said Farukh Khan, Senior Vice President, Head of Fifth Third Wealth and Asset Management Technology. “With its dedicated implementation team and Catalyst program, Wealth Access gave us the resources necessary to stand up Fifth Third Wealth Advisors quickly and with the integrations we needed from day one.”

We could go on for a lot longer talking about everything we learned and shared at Summit, but for now we’ll just say thank you to all the participant firms — and let our moderator, Doug Fritz, have the last word.

“I moderate dozens of open conversations each year, but the Wealth Access Summit was a unique experience. It’s not often that you can connect so many influential bank organizations in one place for intimate discussions about their operations, technology solutions, and top growth opportunities,” said Doug Fritz, CEO and co-founder of F2 Strategy. “It’s critical that bank executives establish clear lines of communication with each other so they can solve problems in the industry collectively and the Summit allowed for that to happen.”

Start Your Own Digital Transformation

When you unify your data, you have access to the innovation that can lead to new revenues. Ready to learn how to make it happen in your organization?

Contact Wealth Access today to schedule a demo.