As we enter the new year, we remain focused on delivering cutting-edge, data-driven solutions that...

Fall 2022 Release Notes and Product Enhancements

The year is beginning to wind down, but product development at Wealth Access isn’t taking a break.

We have grown our product and development teams this year, and we’re continuing our push to innovate and expand our Customer Data Platform for your benefit.

In this month’s Product Update, we have enhancements across Client Experience, Reporting and Analytics, Banking tools, and much more.

The items in this release will automatically go live to all Wealth Access users that subscribe to the applicable service offering on October 22.

For even more information on the new updates click here to register for the release overview on October 18th.

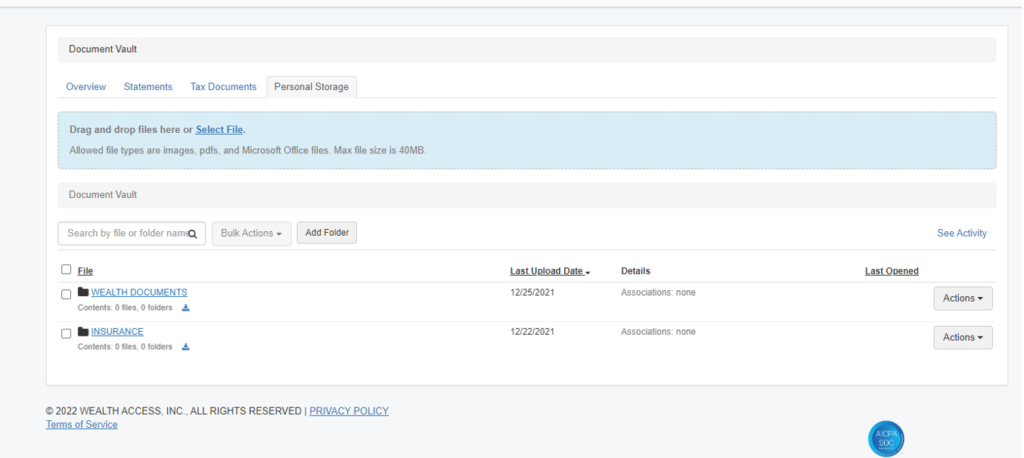

Document Vault V2

We’re excited to announce our all-new document vault experience that builds upon and enhances the previous version to deliver greater usability to you and your clients. The new and improved Document Vault standardizes tabs including overview, statements, tax documents, and personal storage. Not only that, they all come with improved search.

This new version of the Document Vault will allow for better organization of document types (including account statements, tax documents, and more) into standardized tabs within the Vault, as well as improved filtering capabilities by file name, account, and date. The following tabs will be available within the improved Document Vault:

Overview Tab – Displays all documents uploaded to the Vault either systematically or manually over the last 30 days. The Overview tab will be a summary of all document types.

Statements Tab – Displays all feed-driven account statements for the last 90 days by default. Users may select additional date ranges for viewing.

Tax Documents Tab – Displays all feed-driven tax documents for the user’s accounts for the current calendar year, or selection of additional date ranges.

Personal Storage Tab – This is the only option that allows the user to upload or delete documents. This tab will allow clients to manually upload and store any additional documents (up to 40MB) they might want readily accessible to them or their financial team.

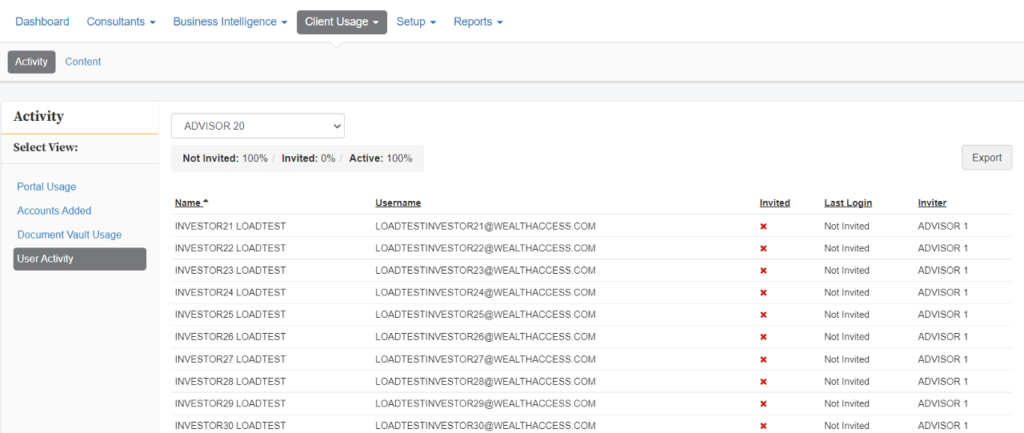

Firm-level Reporting

New reporting options are now available to give you deeper insights firm-wide. The new client activity grid displays administrative level statistics on firm level user activity. Statement Delivery Monitoring shows you the number of statements delivered, as well offers exception reporting. You can also get new analytics on the updated Document Vault usage.

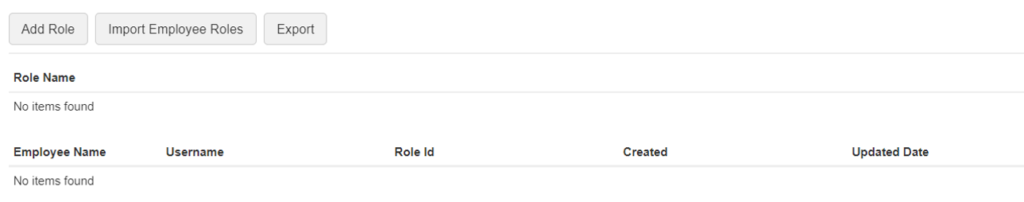

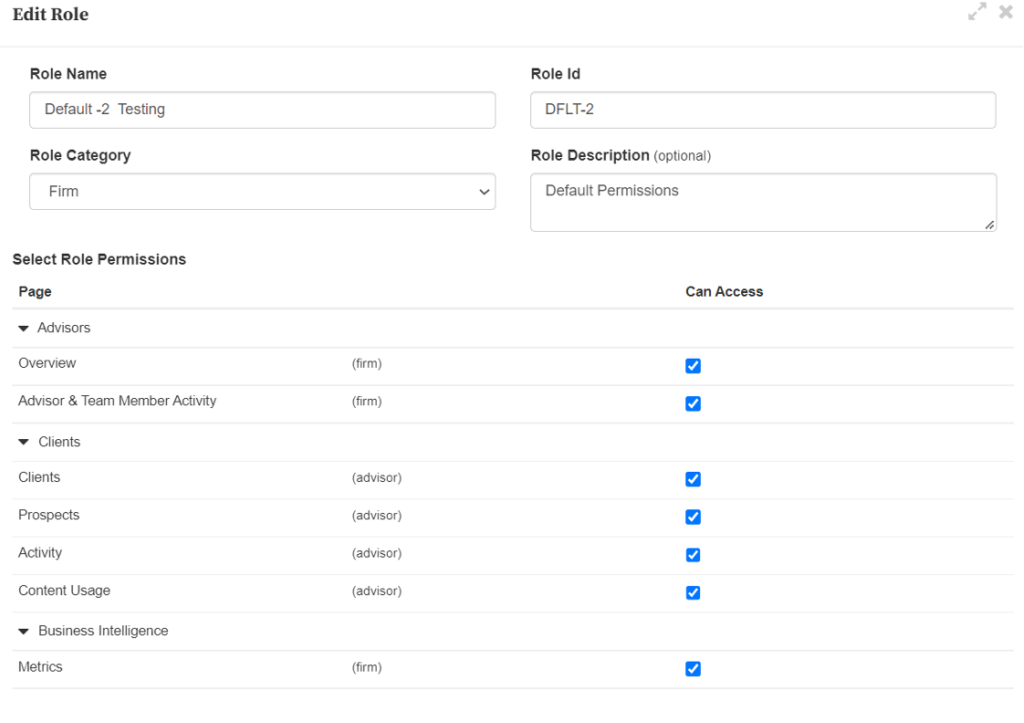

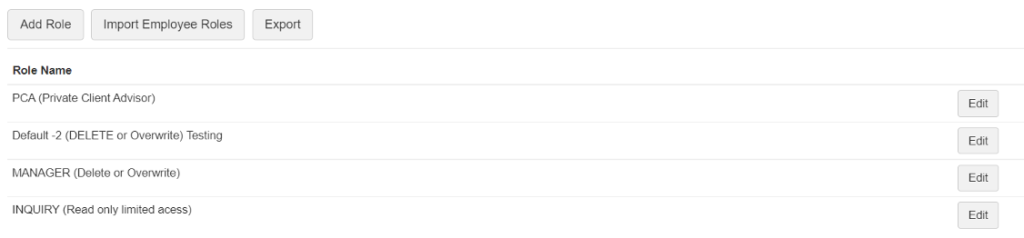

Roles-Based Hierarchy

New functionality for the Roles-Based Hierarchy provides enhanced ease-of-use for role maintenance and additional features, giving your firm’s administrator more granularity and control in managing internal user permissions.

Firm administrators within Wealth Access can now use a system-generated Excel spreadsheet template to import and assign users to a pre-existing role directly in the Wealth Access user interface, which can also be automated through nightly processing.

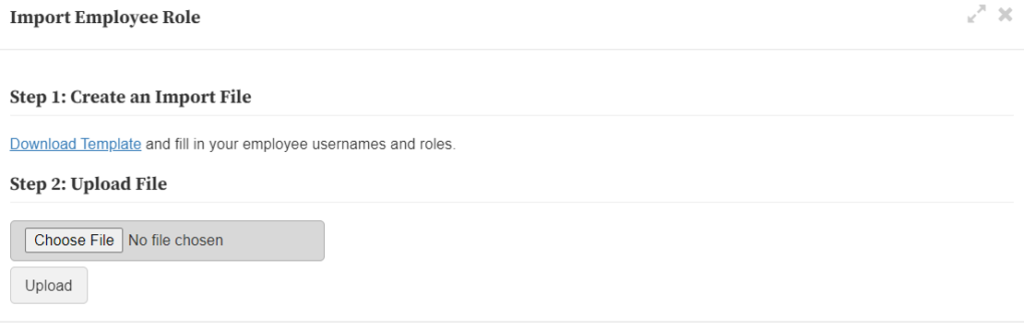

Client and Prospect Invitations

Wealth Access clients currently utilizing our Roles-Based Hierarchy and Prospect features can now create multiple, customized invitations for both prospects and clients. Firm administrators can create multiple unique invitations and assign to individual roles, allowing your firm to target specific groups of clients with specific messages.

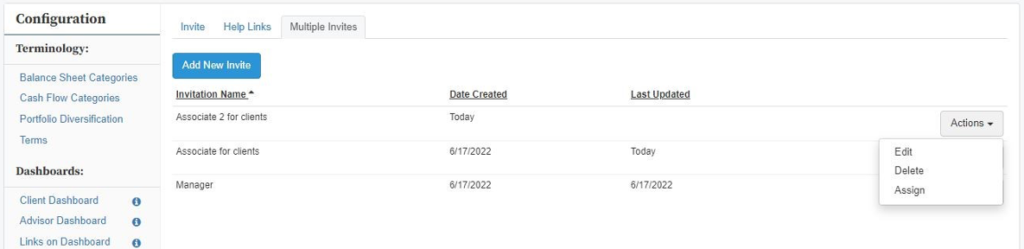

Jack Henry Banno Widget Integration

You can now integrate our investor-level Wealth widgets with your institution’s Banno digital banking portal. As a result, your clients can see a complete snapshot of both their wealth and personal banking information right on the dashboard of your firm’s online digital banking site.

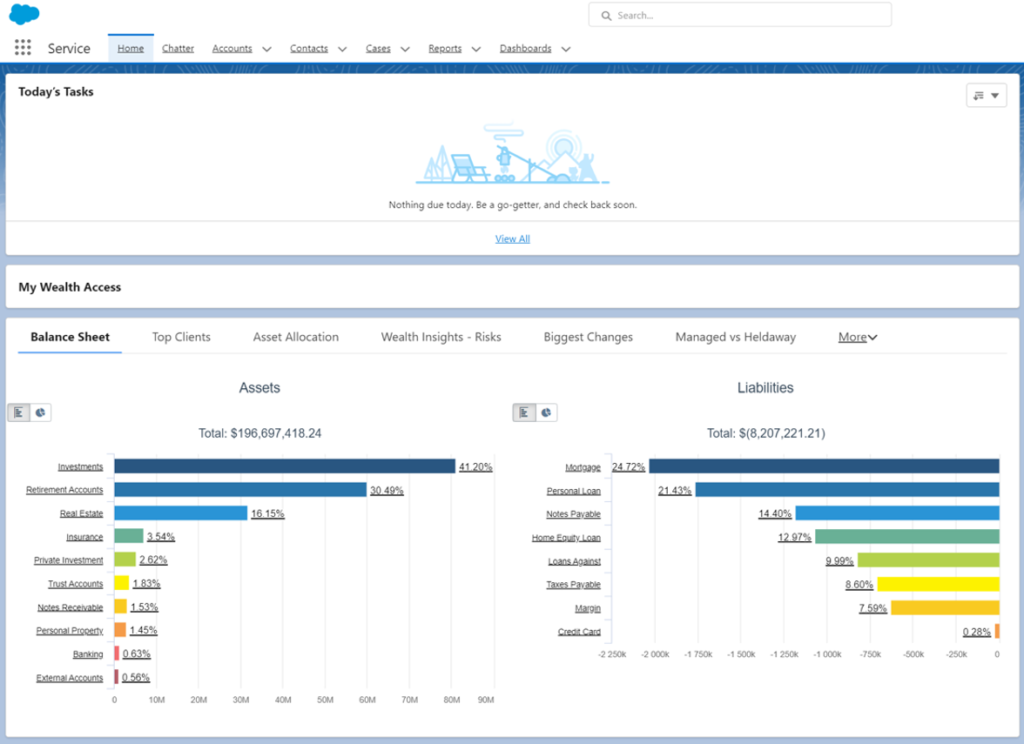

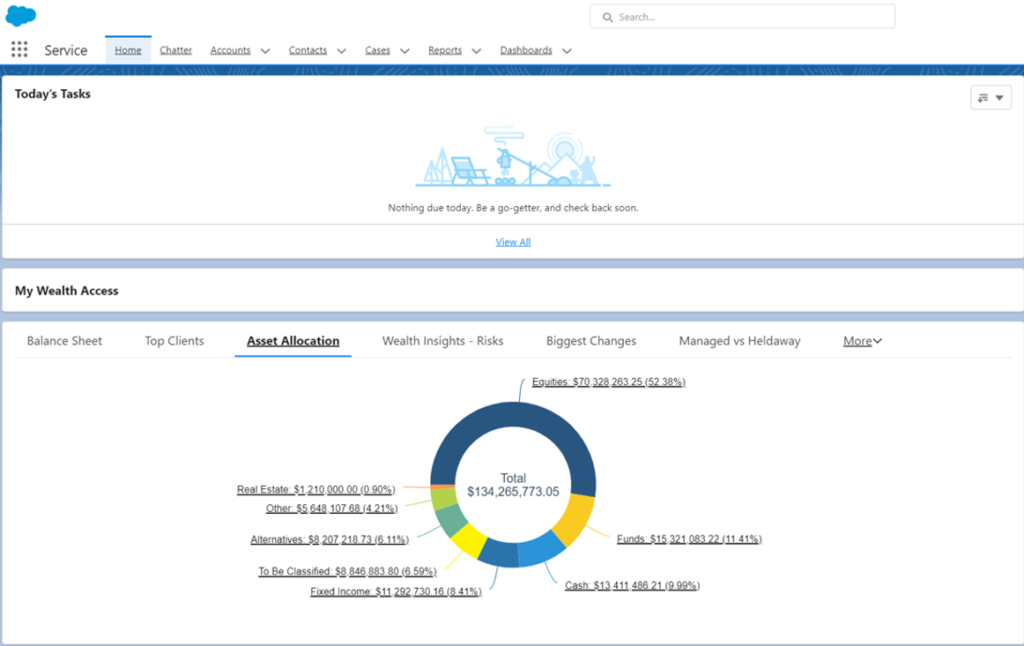

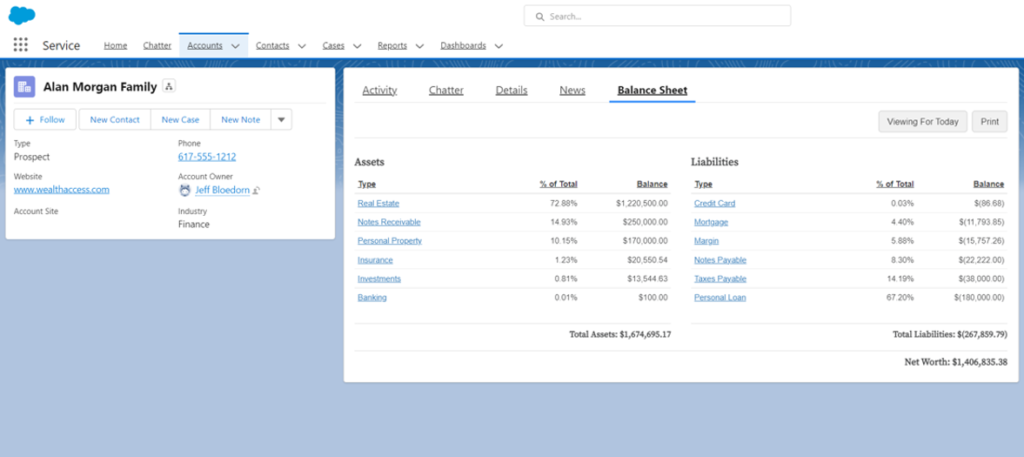

Salesforce Widget Integration

Our latest Salesforce integration allows your firm’s internal team the ability to see the client’s full financial portfolio, as well as view their full Book of Business information, directly in your CRM. Access investor and advisor-level widgets directly in your institution’s Salesforce CRM. Add one or more Wealth Access widgets to your firm’s Salesforce application through the addition of custom Lightning components.

Salesforce Integration: Advisor level Balance Sheet, Book of Business view

Salesforce Integration: Client-level Balance Sheet view

Salesforce Integration: Advisor level Balance Sheet, Book of Business view

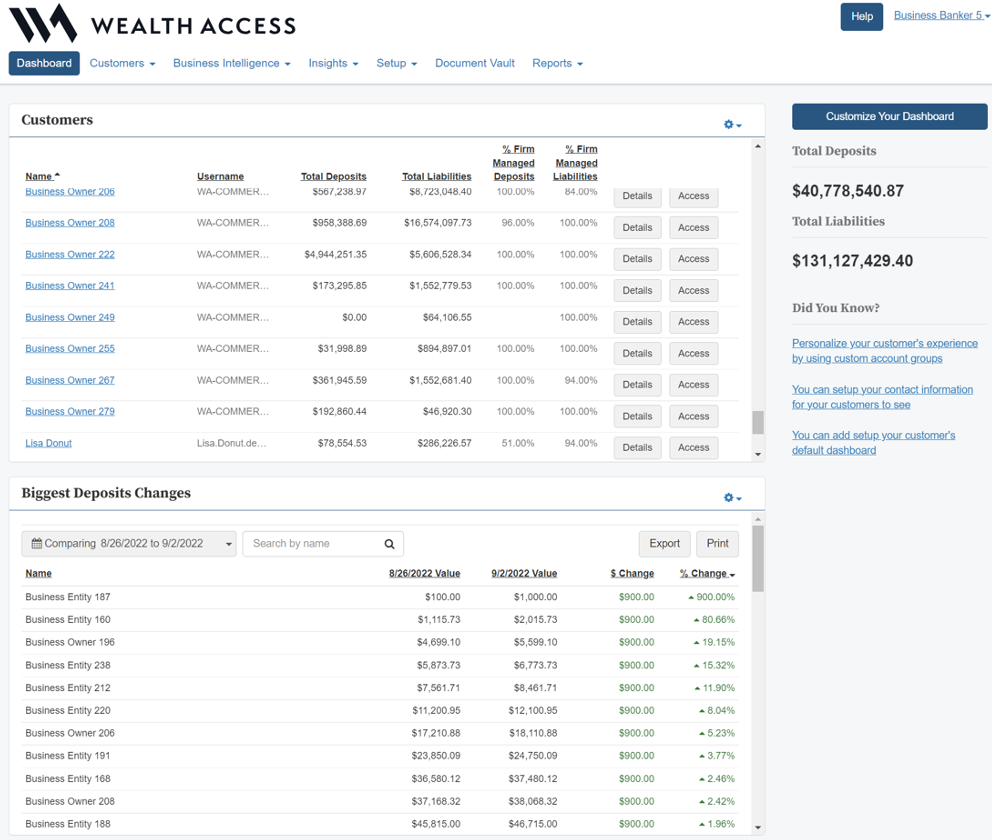

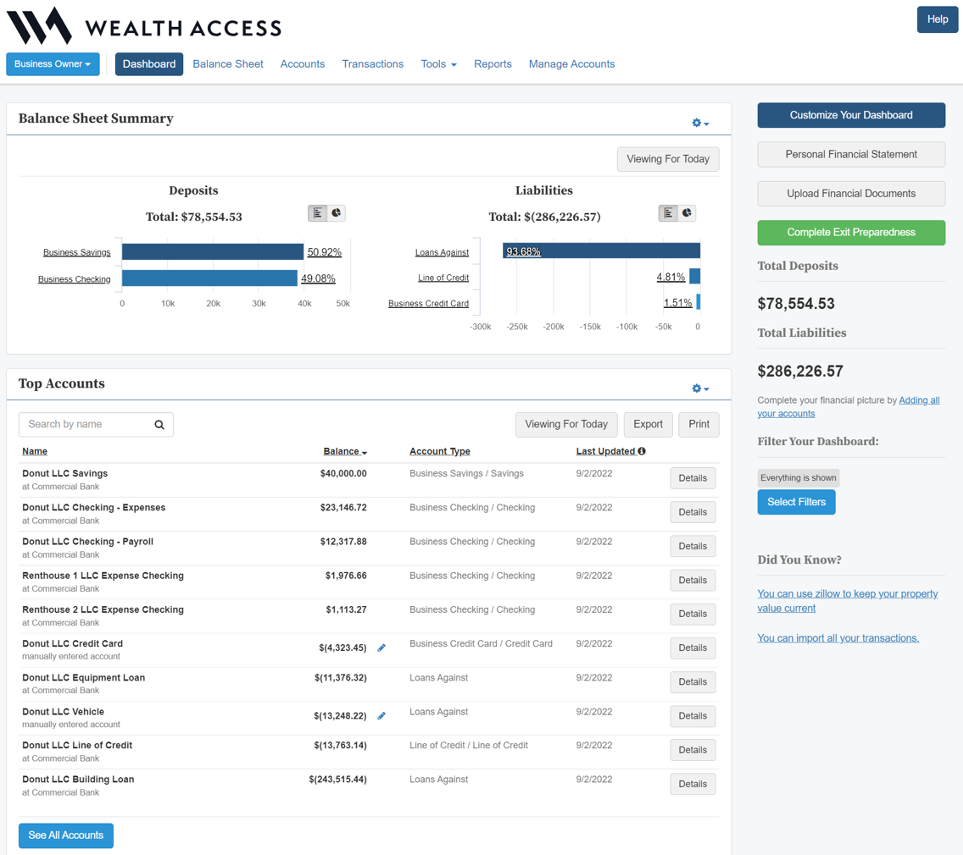

Wealth Access for Commercial

Wealth Access for Commercial is a new digital experience specifically created for small business owners and small business bankers that unifies existing books and records across systems. Gain practical insights as both a business owner or banker without jumping from system to system. Take advantage of a secure vault to store and share documents bidirectionally. A business owner can even toggle between the different types of data they have with your financial institution.

Business Banker View

Business Owner View

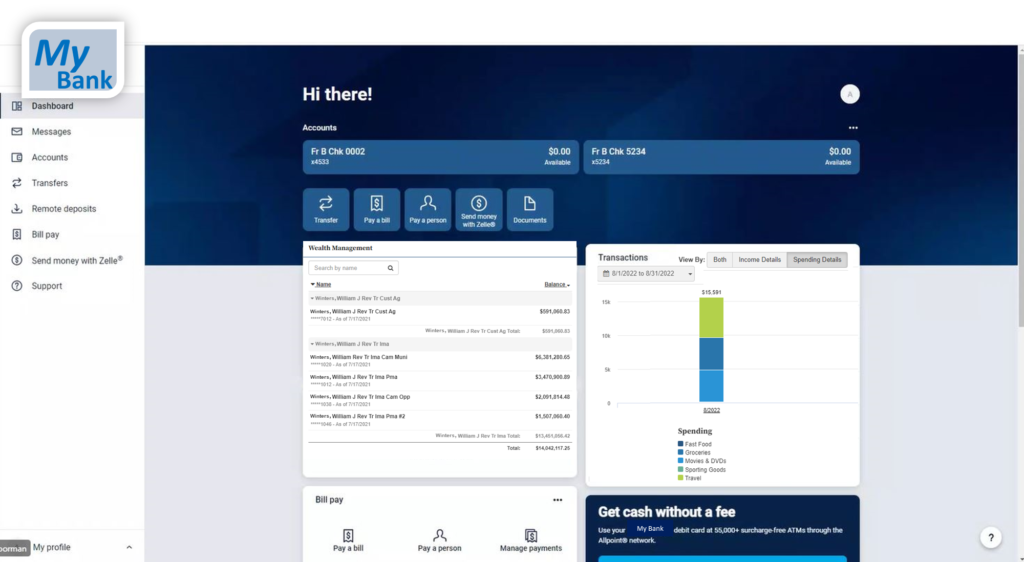

Digital Banking PFM

Just as Commercial Integrations offers unique experiences for business owners, Digital Banking PFM provides a set of personalized financial management widgets – each of which can be presented in your current digital experience.

Widgets include the Document Vault, external accounts, and cash flow monitoring, allowing you to provide simple and practical personal financial management widgets for your customers.

International Access

Your firm’s Wealth Access users can now access their digital portal from low-risk countries outside of the US, including Australia, Canada, England, Germany, Israel, Italy and Peru. Users will no longer be required to have Wealth Access whitelist IP addresses when accessing the Wealth Access portal from these low-risk areas.

New Open Banking Financial Institutions

As of June 2022, the following providers have migrated to Open Banking: Chase, Charles Schwab, Capital One, Citi Bank, Wells Fargo, Bank of America. As of September 22, TD Bank is in the process of integrating to Open Banking and will be complete on October 22, 2022.

Open Banking provides a faster, more reliable, and overall better user experience for customers when connecting to outside accounts on the Wealth Access platform. Access to these new connections is available to all Wealth Access customers utilizing the above-mentioned connections.

For more information on the steps required to establish an account connection utilizing Open Banking, please contact our Client Success Team.

There are even more enhancements coming to the Wealth Access platform beyond those covered in today’s blog. We’ll be providing more information in the coming months about these additional updates.

Coming Soon

eMoney integration – We’re making it easier to manage client finances and create financial plans with a streamlined process.

Document Vault enhancements to allow for Greenhill performance report delivery to Wealth Access vaults.

Learn More About Wealth Access

Want to discover more ways Wealth Access’ updates can make your financial institution more efficient? Click here to connect with a Wealth Access team member and schedule your free demo today.