From the middle class to the wealthiest families in the country, most families find it incredibly...

7 Communication Channels Banks Should Leverage in 2022

Client communications are a constant focus for financial institutions – you have to keep customers informed of how their money is doing or else they’ll take their business elsewhere.

In fact, “Customer Service Experience” and “Straightforward Practices” are two of the top ten reasons customers switch banks, according to a recent Morning Consult survey. Clear and open communication can go a very long way toward making sure your customers are happy with both of those areas.

In 2022, your clients and customers expect to be kept in the loop. Today, we want to discuss how you can use content to keep up with client expectations – and make sure you’re not leaving anyone in the dark.

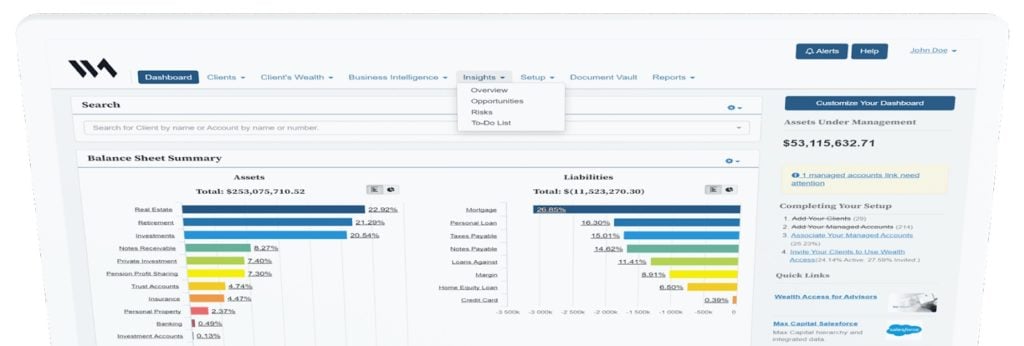

1. Notifications in Client Dashboard

Your client dashboard is the center of all communications. Your customers are already there to see how their finances are doing, so it’s the perfect time to give them relevant messages.

One of the most popular sections we add to dashboards for banks is a communication section like the sidebar below.

Here, you can send notifications, share relevant articles from your blog, list outstanding items customers need to address and more.

The catch 22 of communicating with your customers via the dashboard is that the ones who use the dashboard the most are the ones who tend to already be proactive about keeping their account up to date and reading your relevant info.

Still, dashboards are an absolutely essential part of keeping your customers informed – and there are other ways to reach people who may not spend much time in your customer portal.

2. Push Notifications

Mobile banking has carved out a significant role in the online banking world, allowing customers to check in quickly, easily and conveniently – no matter where they are. Having a mobile app is table stakes for every bank in the country – large or small – these days.

Related: Download our case study with AMG National Trust Bank

And it’s easy to see why. Nearly half (48%) of online banking customers prefer to access their account info via mobile apps.

For reaching your customers where they are, few communication channels beat mobile notifications.

3. Email

No matter how much Mark Zuckerberg may disagree, email isn’t going anywhere. It’s future-proof and still the most effective digital communication channel by far.

Of course, you don’t want to overdo it, but sending one to four emails per month with your bank’s latest news along with relevant articles can go a long way in strengthening the ties between your institution and your customers.

4. Texts

Texting alerts are a newer idea, which means they still boast a fairly high engagement rate, and customers are still fairly open to getting them. According to a study published in May 2022, more than half of banking customers indicated they would be willing to receive text alerts regarding banking activity.

5. Blogs

According to pretty much every study on Gen Z, they want transparency from the companies they work with. Your bank’s blog is a great place to establish your bank as an open and honest institution. Articles on your company culture, mission and core values can go a long way in building trust.

6. Social Media

Like your bank’s blog, your social media channel is a great place to invest in enhancing your bank’s reputation as transparent and fair.

7. Video

Video boasts one of the highest engagement rates of all communication formats. Online videos comprise more than 82% of all internet traffic.

Whether you’re talking about the latest changes to your customer portal or you’re creating product videos for your website, if you say it with a video, your message is much more likely to be heard.

Pro Tip: Segment Your Customers

Finding the “Goldilocks” level of notifications is difficult. Hit your customers with too many notifications, and they’ll get frustrated. Don’t hit them enough, and they could miss important information.

No matter how much you want every customer to get every notification, there will always be people who just don’t care to check in that often. If you want to keep your customers happy, give them varying frequencies of notifications.

Getting the right message to the right clients can be tricky, but with the right communication channels in place, you have a much better chance of being heard.

Get Started with Wealth Access

Wealth Access was created with one goal in mind: making sure every advisor on your team and client they serve has access to the information they need. In a word, our goal is communication. Want to see how we could help your bank? Click here to schedule a demo.