Many advisors have dreamed of quitting their job and starting their own business, but actually...

Three Must-Know Growth Strategies for Financial Advisors

Most financial advisors can complete a discounted cash flow analysis or rebalance a portfolio with a few clicks, but marketing and growth strategies may be completely foreign. Even if you know what you should be doing, you may have trouble deciding where to focus or how to get started. The good news is that most successful growth strategies boil down to following simple processes, while new technologies have made them easier than ever to execute.

In this article, we will look at three growth strategies for advisors and how to implement them to build your book of business.

Look Inward First

Many advisors hear the term growth strategy and immediately think of outbound marketing, but the best place to start is with your existing clients. Advisors have traditionally relied on moving over existing investment assets and committing clients to a plan to build up their assets over time, but many of these clients may have had external accounts that they either forgot or didn’t think to mention that weren’t brought into the fold.

Data aggregation technology has made it possible to quickly and easily identify these assets and optimize the client’s complete financial picture. By connecting with multiple different financial institutions, these technologies help advisors get a comprehensive look at a client’s assets and liabilities. This helps you deliver more value by creating a better plan, while alerting you to potential held-away assets that could be brought under management.

In a recent survey, advisors using Wealth Access said they convert 65 percent of held-away assets into managed assets when they bring them onto our Intelligent Aggregation platform. You can download our free whitepaper to understand how advisors are using these technologies to improve the quality of their investment advice and acquire additional assets, as well as how you can put Intelligent Aggregation to work for your firm.

An added benefit is that many clients are also demanding data aggregation as a standard account feature. In fact, Carson Group Partners brought in $1.5 billion in new committed assets after rolling out a new client portal that aggregated data from all of a client’s accounts into a single location. Wealth Access offers these same features for advisors looking to implement data aggregation into their businesses and similarly accelerate their growth.

Systematize Referrals

Referral marketing is a great low-cost, high-return starting point for generating new leads without external marketing efforts. Many advisors feel uncomfortable asking existing clients for referrals, but the reality is that most high net worth individuals prefer to be referred to an advisor by someone they trust. The most successful advisors realize this and systematically build their book of business by asking for referrals four or more times each year.

The best way to get started with referral marketing is to set up a system to automate the process. Marketing automation tools, like MailChimp, make it easy to set up automatic emails to your client list. For example, you might automatically add new clients to a client email list and create a marketing automation sequence that sends three emails a couple months apart that introduce the idea of referrals and set the stage for an in-person conversation.

It’s equally important to make referrals as easy as possible for the client. For example, you may take a look at the client’s LinkedIn profile and suggest a couple people that you would appreciate introductions to and provide a sample email that the client can copy-and-paste. You can even combine referral marketing with digital marketing (covered in the next section) and include a link to a blog or LinkedIn post in the email.

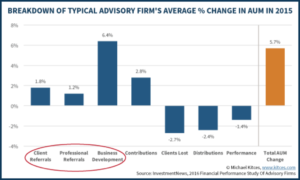

The bad news is that competition from robo-advisors and increased solicitation from large brokers has made referral marketing less effective over time, according to Investment News’ 2016 benchmarking study of the performance of financial advisors. Large firms with more than $5 million in revenue generate just a quarter of their new assets from new client referrals and about a fifth from professional referrals – leaving 57 percent from other sources.

Different Digital Strategies

Digital marketing has become an increasingly popular way to generate new leads. According to Fidelity, tech-savvy eAdvisors have 42 percent higher assets under management, 35 percent higher AUM per client, and 24 percent higher compensation than their non-tech-savvy peers. Nearly all of these advisors (94 percent) used LinkedIn, Facebook, or Twitter to engage clients or prospects and more than half (57 percent) had websites that tracked and gathered leads.

The best digital marketing campaigns start with a blog that contains thoughtful content that’s relevant to their target market. For example, an advisor focused on small business owners may write about the best retirement plans for business owners. These blog posts can be promoted on social media to drive traffic until they’re indexed by search engines over time. A key benefit of blogging is that it generates a steady stream of traffic over time with a single investment.

Visitors to these blog posts should then be offered something of value in exchange for their email. For example, an advisor targeting retirees may create a short email course about how and when to apply for Social Security. The key is offering something that’s related to the blog post topic and of high enough value to the visitor to hand over their email address. The result is leads that are highly-targeted to your business.

The final step is creating a marketing automation campaign that takes an email address and nurtures the lead into a viable prospect. For example, you may set up a marketing automation campaign that provides some helpful information designed for your target audience and eventually transition into telling them how your firm can help. The goal is to eventually convince some of these leads to call you – creating an inbound lead.

The Bottom Line

Many financial advisors struggle with developing and executing marketing campaigns, but it has never been more necessary to succeed at them. Robo-advisors continue to capture significant market share – particularly from younger generations – while brokers have become increasingly active in converting their self-directed investor base into advisory clients. These are headwinds that can be overcome with effective marketing campaigns.

If you’re interested in streamlining your practice with technology, Wealth Access offers client portals, mobile apps, intelligent data aggregation, and firm-level insights that can bring your business to the next level. Contact us today to schedule a free demo.