The WealthManagement.com Industry Awards program has been designed to recognize the companies and...

Product Spotlight: Wealth Insights

Wealth Insights is centered around proactively identifying opportunities, trends, and risks across your client base by applying business intelligence techniques across clients’ account data, login activity, and profile information.

Advisors have access to Wealth Insights to help them proactively identify opportunities to expand their relationship and increase engagement with their clients. Firm administrators can view the same data broken down by each advisor to provide support where needed and can even configure custom opportunities.

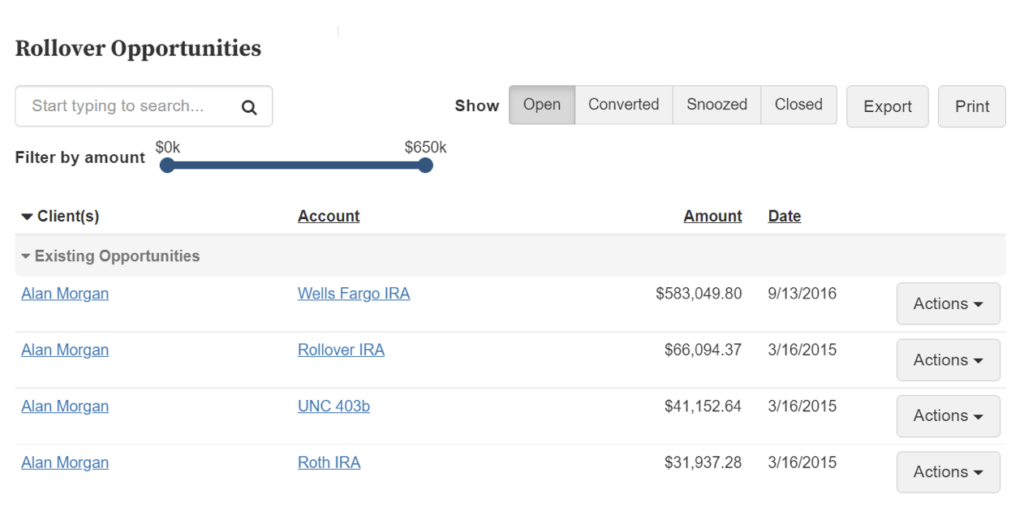

Opportunities

Rollover Opportunities monitors for retirement accounts that are not assets under management for your firm.

Investible Cash tracks cash assets as a percentage of a client’s portfolio and identifies large percentage increases.

Money in Motion identifies large deposits to pinpoint significant changes across an advisor’s book of business.

Risks

Active clients not using aggregation is an indicator that helps Advisors understand which clients are not using the incredibly useful aggregation feature by connecting outside accounts.

Clients with a last login greater than 3 months tracks clients who could stand to benefit from engagement, which reduces churn.

Invited clients who have not setup their account assists advisors by displaying those clients who are not yet benefitting from your digital experience of choice.