Wealth Access continues to make investments in the development and extension of your mobile/digital...

June 2020 Wealth Access Release Notes

Wealth Access continues to make investments in the development and extension of your mobile/digital client experience and the advisor and firm tools that help drive insights and efficiencies in your organization.

This release will automatically take place on Thursday, June 11th. Please note that several of these enhancements are configurable and will not alter your current configuration until you decide to enable them.

Product Updates

Client Updates

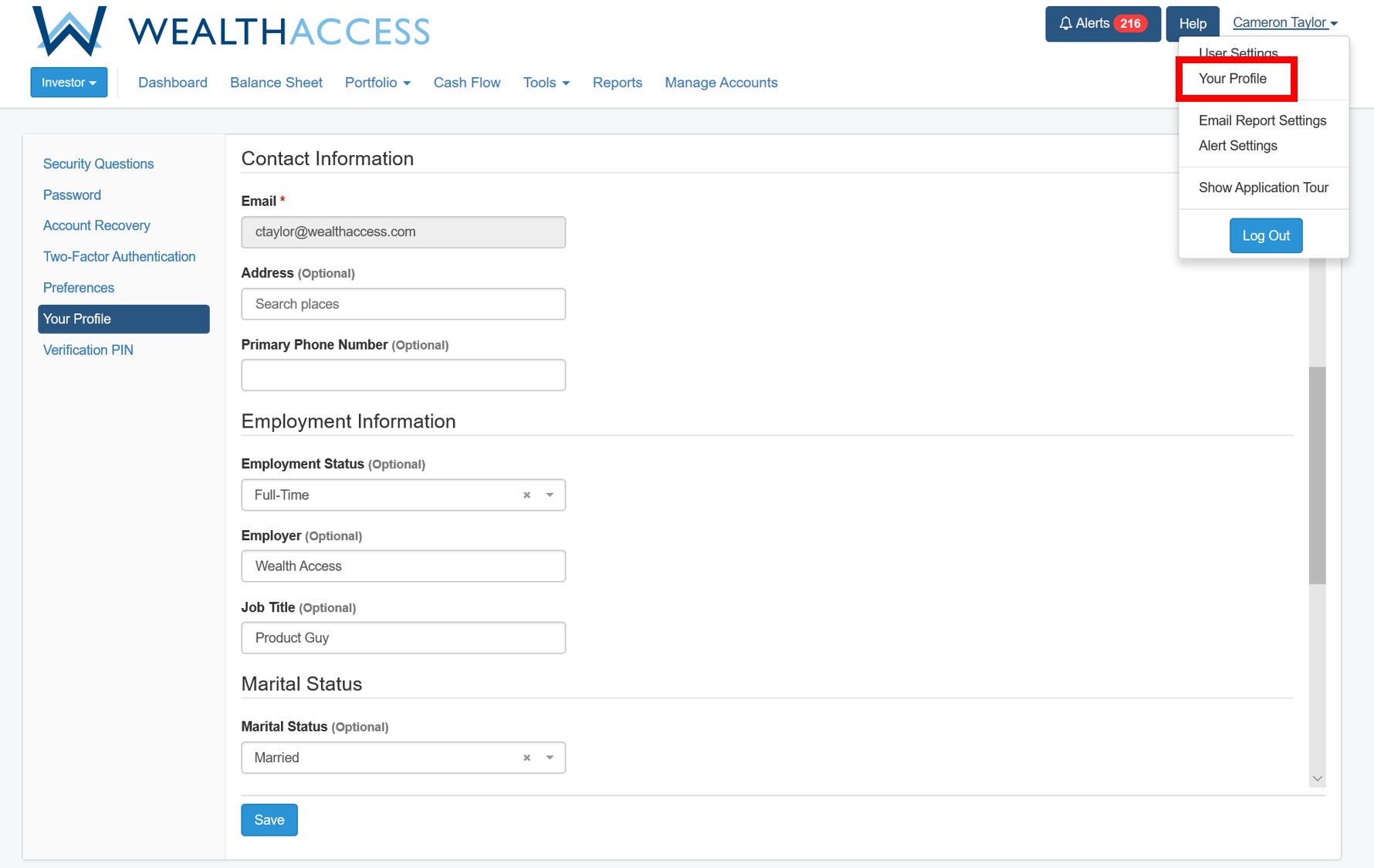

Client profile information

We have added a new page to collect additional client profile information including address, date of birth, marital information, employment information, and dependent information.

This information can be collected throughout the prospect to client journey and entered collaboratively between either the client or wealth professional. It can also be used to facilitate downstream applications like new account onboarding, proposal generation, and CRM.

To enable the Client Profile capability, please contact the Wealth Access Client Success team.

Prospecting Updates

New ‘Prospect’ user

We are excited to add a new Prospect user type to the system that allows you to separate prospects from clients on your dashboard, offer a greatly enhanced onboarding experience for prospects, and allow you to easily track where your prospect is in the onboarding experience.

Enabled in the advisor portal, users will now see Prospects listed under the Clients tab. Advisors can now add prospects directly from that page and invite the prospect to set up a Wealth Access account to facilitate prospect profile, financial account, and document collection.

In addition, users can track exactly what the prospect has done in the system from account setup, entering profile information, adding financial accounts, and signing documents.

To enable the enhanced prospecting capabilities, please contact the Wealth Access Client Success team.

Prospecting onboarding workflow

When prospects are added to the system, we have greatly enhanced the onboarding experience by adding a step by step workflow process of setting up their profile and account information before navigating them to their client portal dashboard.

The workflow process first takes them through the client profile screen which has been setup in a series of tabs to collect the profile-level information (described in the Client Profile section of the Release Notes). It then moves them to the Managed Accounts screen where they can add financial accounts through aggregation or manual entry. And finally, it brings them to the Document Vault to review any documents that advisors may have shared with them. Once they are finished entering information, they can proceed to the main client portal landing page.

Advisor Updates

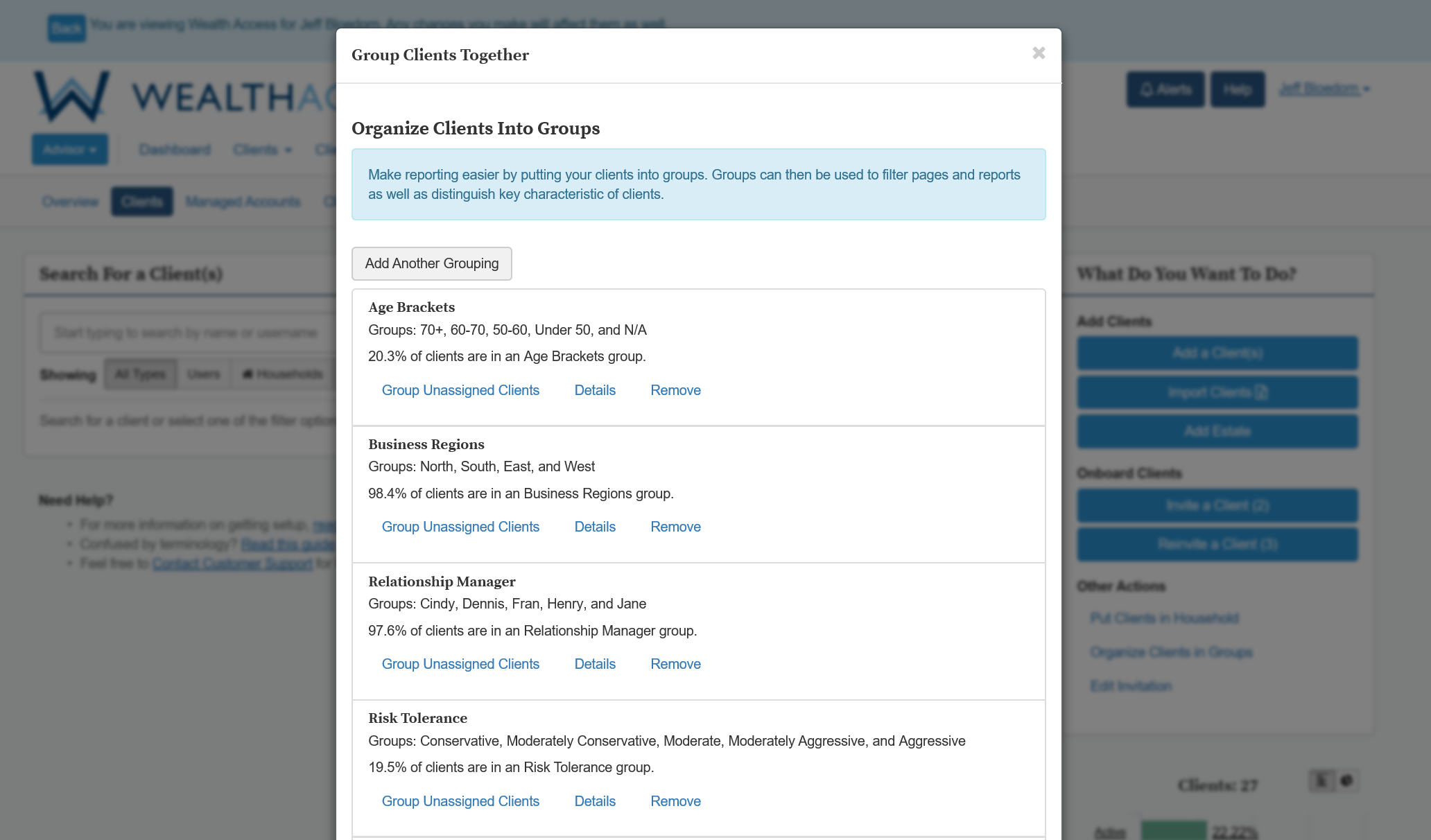

Enhanced client grouping

Client grouping is a powerful feature of the advisor experience that allows users to segment a set of clients by user-level defined characteristics. Example characteristics are age, business region, relationship manager, risk tolerance, and client tiers. Through an easy drag & drop user experience, users can group clients based on how they operate their wealth practice.

We are excited to enhance the usability, user experience, and performance for this area of the platform..

Coming Soon

Wealth Insights

Throughout 2020 we will be enabling enhanced insights for firm executives, administrators and advisors to allow them to better understand risks, trends, and opportunities across their client bases. By applying business intelligence techniques across clients’ account data, login activity, and profile information, advisors will be able to proactively respond and take action to deliver a higher level of client satisfaction and to move additional assets from held-away to managed.

As part of this release, we continue to invest in Wealth Insights with a focus on the engine that systemically identifies opportunities for wealth professionals to proactively pursue. As opportunities are identified by our engine using firm-level rules, they are viewable by your employees through our new Insights tab in the Advisor portal.

We have also added a new To Do List that wealth professionals can use to track in-progress opportunities or any other activities they need to track at the client level.

We are looking for early adopters for Wealth Insights with a planned Beta launch in August and general availability in October. Clients must subscribe to the Wealth Access Firm Insight module in order to enable the Wealth Insights capabilities.