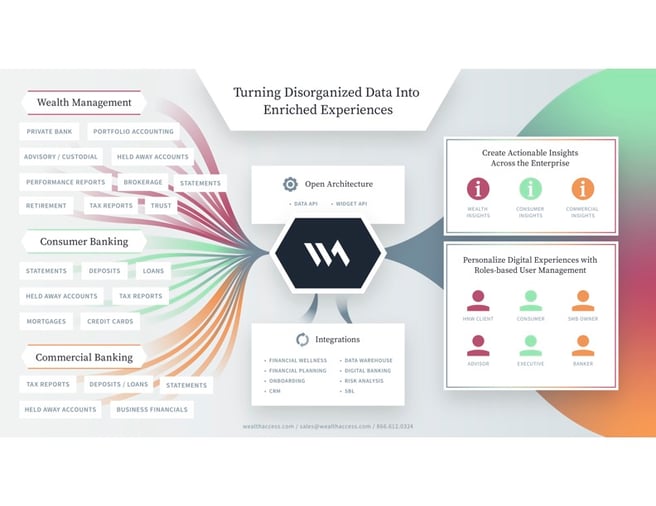

This unique partnership combines the industry’s largest independent personal financial management...

How One Bank Uses Wealth Access to Maintain Close Relationships with Digital Customers

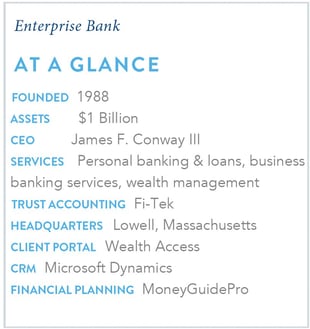

A company with deep roots in banking and trust services may not be the first name that comes to mind when talking about digital leaders in wealth management – but Enterprise Bank isn’t a typical bank.

A company with deep roots in banking and trust services may not be the first name that comes to mind when talking about digital leaders in wealth management – but Enterprise Bank isn’t a typical bank.

When the pandemic took financial services by storm and forced businesses everywhere to transition its employees to remote work, the team at Enterprise Bank’s wealth management division was ready.

“We’ve always tried to be progressive with our use of technology, both internally and externally. A robust digital presence is essential for any organization’s success today,” said Stephen Irish, CPA, CFP, Managing Director, Enterprise Wealth Management and Chief Operating Officer, Enterprise Bank.

Click here to download this case study.

“As our industry has moved more toward full-breadth wealth management and away from a focus on investment management, we’ve evolved along with it. The technology we have at our fingertips allows us to provide a full financial perspective to our clients, and also gives a complete view to our financial advisors.”

One of those pieces of technology that Enterprise Bank uses to cultivate client relationships is Wealth Access, which the company chose in part for its ability to deliver a complete balance sheet view for every wealth management client.

Click here to download this case study.

“Anyone who’s been in wealth management for any length of time knows what a stumbling block to deeper financial planning discussions gathering data is. You can’t turn over a multi-page document and expect to get it fully filled out, then key it all in, and use it—it’s out of date in a month,” Irish said. “Wealth Access’ aggregation collects all the data for us and keeps it current. Along with its MoneyGuidePro integration, we can easily keep client data fresh even as situations and portfolios change.”

Irish has seen firsthand how the addition of Wealth Access has helped the wealth management team to move at a quicker pace. As conversations shift from a myopic look at investment performance, financial advisors have an easier time framing conversations around financial and lifetime goals. And as advisors enjoy more productive conversations on one hand, they also increase efficiency in other areas of the business.

“Our financial advisors, client service associates, and portfolio managers all work collaboratively  together through our CRM, Microsoft Dynamics, and Microsoft Teams,” Irish said. “No matter if they are in an office or remote, they can access the documents needed to quickly engage prospects and

together through our CRM, Microsoft Dynamics, and Microsoft Teams,” Irish said. “No matter if they are in an office or remote, they can access the documents needed to quickly engage prospects and

clients and get them what they need.”

In its next phase of technology enhancements, Enterprise Bank will look for ways to integrate Wealth Access more completely into Microsoft Dynamics so it can provide its advisors with a true single dashboard view into anything they might need for a client.

“With one dashboard, our advisors can get all the information they need to manage client relationships, their pipeline, emails, and access any files stored in the Wealth Access document library,” said Irish.

“As we look for more ways to continually strengthen relationships and get deeper into financial planning conversations, centralizing Wealth Access will help our advisors have factual discussions that aren’t simply based on anecdotal evidence. Ultimately, that allows us to come up with more customized and nuanced planning and allocation strategies that will better serve our clients.”